Stamp Duty & Registration charge are paid just before the registration of sale deed

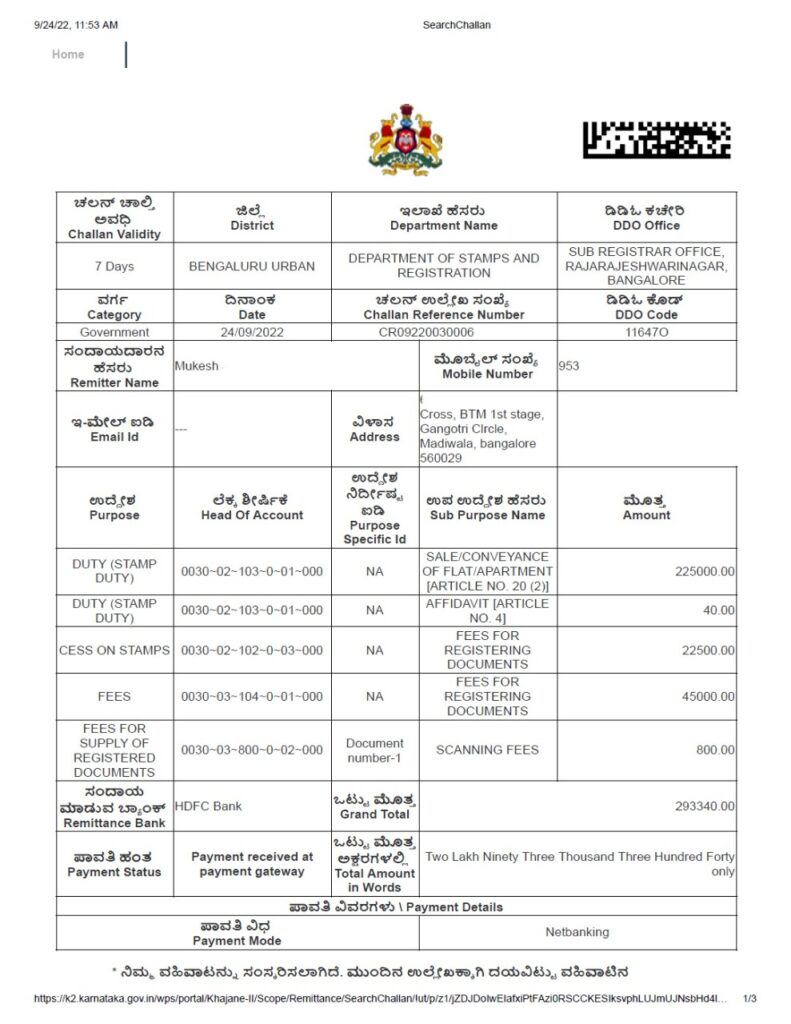

In Karnataka, Stamp duty and Registration charge are paid online and generate the challan. The challan looks like below image

The above challan is valid for 90 days from the day of payment so one can register the property within 90 days

We provide assistance to pay Stamp Duty and Registration charge. To opt for our service, please write to us pgnproperties@gmail.com or Whatsapp to + 9 1 - 97424 79020.

Thank you for reading…