The process is simple and easy to gift immovable property to blood relation. The best part is that stamp duty & registration fee are very less for blood relations.

Four-step process to gift the immovable property

- Documents

- Draft

- Government charges (Stamp Duty & Registration fee)

- Registration

Let us explain in detail below

__________________

- Document (require for Gift deed registration):

- Donor’s registered deed

- Encumbrance certificate

- Tax paid receipt

- Khata certificate & extract

- Donor’s Aadhar and PAN

- Donee’s Aadhar and PAN

———————————————

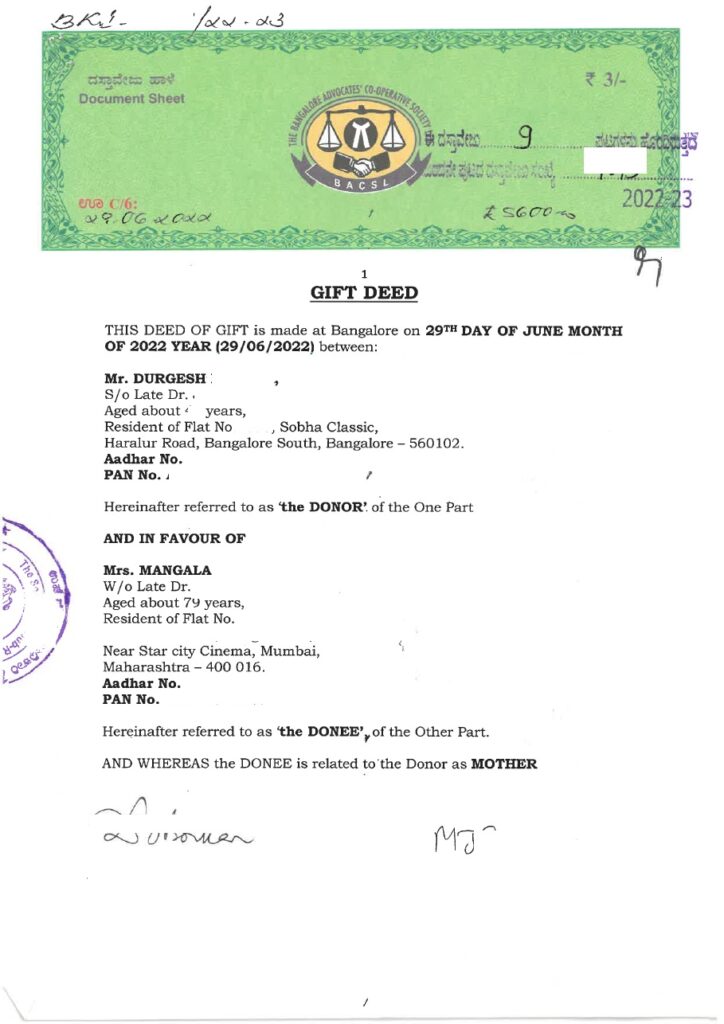

2. Draft: Prepare a gift deed draft in word format, a draft looks like below image

————————————————-

3. Government charges: (Subject to Karnataka).

- Stamp Duty: Rs. 5150

- Registration fee: Rs. 1000

- Cess: Rs 500

- Scanning Rs. 450 (approx)

Below is the image of Payment receipt:

Above government charges are applicable to blood relatives only, Following people come under blood relative category

- Father

- Mother

- Brother

- Sister

- Husband

- Wife

- Son/Daughter

Uncles, cousins, nephews, in-laws don’t come under blood relative category

4. Registration : (Below is the step-by-step activity to register gift deed in Sub-registrar office)

Step 1: Carry the following documents to sub-registrar office. All originals and 1 set of photocopy

- Donor’s registered deed

- Latest encumbrance certificate

- Current financial year tax paid receipt

- Khata certificate & extract

- Donor’s Aadhar and PAN

- Donee’s Aadhar and PAN

- Printed GIFT DEED (to be registered)

- Government charge payment receipt

- Active mobile phone for OTP authentication

Step 2: As soon as you enter the sub-registrar office, officer verifies your payment receipt (of government charges. They check the payment success report)

Step 3: The chamber officer verifies all the above-listed documents and approves for registration

Step 4: The donor and donee sits in the registration counter, officer takes the photo of donor & donee via webcam placed on computer monitor, takes biometric thumb impression and gets Aadhar-based OTP authentication.

Step 5: The registering officer handover the property summary report to donor & donee for cross-verification of property specification. Go through summary report for any corrections.

Donor & donee sign the summary report and handback to registering officer.

Step 6: The Donor and Donee sign all pages of gift deed. Two witness signs at last page of gift deed.

Step 7: The registering officer writes the registration number at all pages of gife deed. Officer scans the gift deed for government record.

Step 8: Registering officer Handover the registered gift deed to Donee.

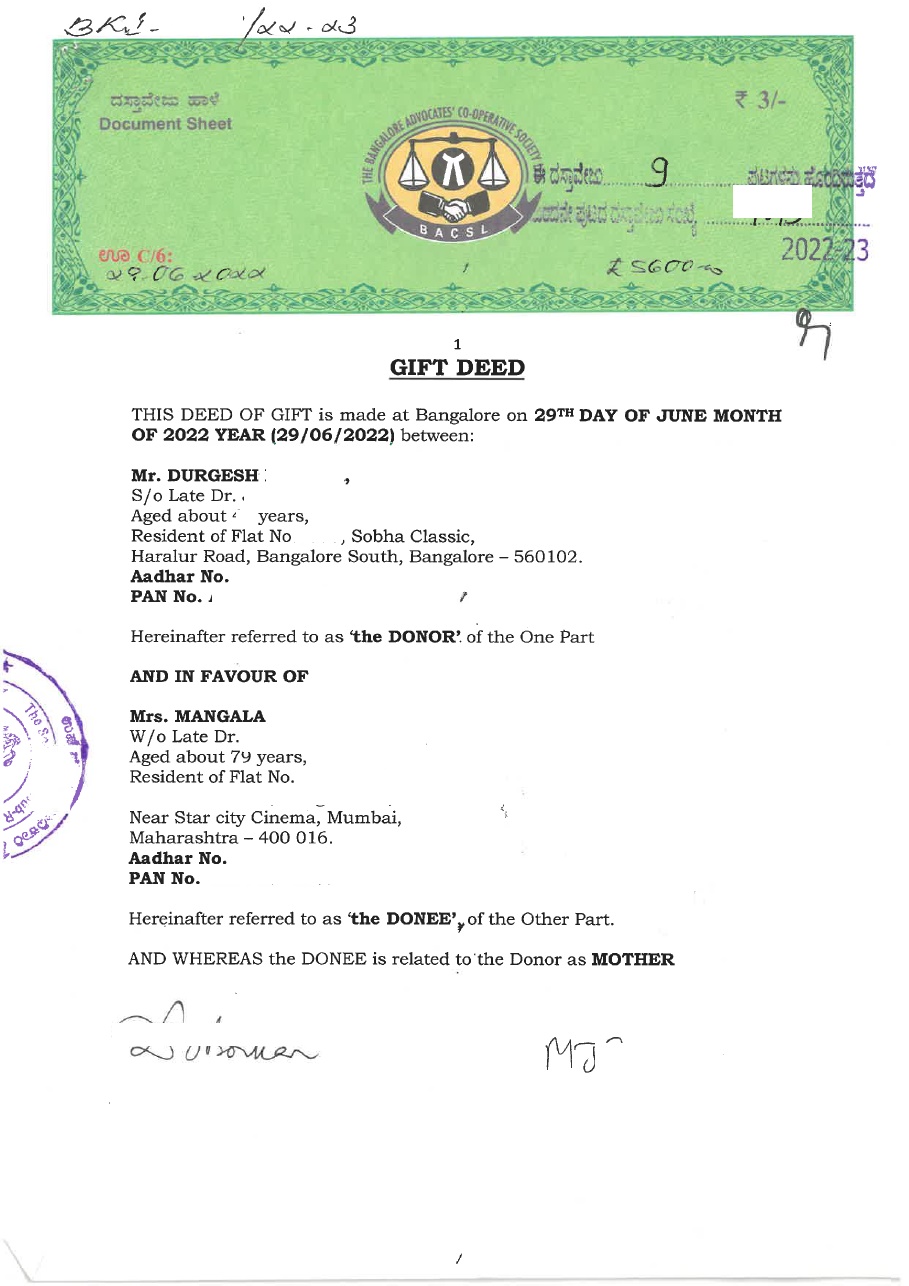

The registered gift deed looks like below image (Son gifted to mother)

After gift deed registration:

- Do the khata transfer from Donor’s name to Donee’s name

- Change the name in property tax record and utility bill from Donor’s name to Donee’s name

This completes the process to gift the immovable property to blood relation.

In Bangalore, we provide end-to-end assistance to register Gift Deed+ Khata Transfer + name change in Tax record. To opt for our service, please write to us pgnproperties@gmail.com or Whatsapp to + 9 1 – 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…