- Registration

- E -Stamp

- Adjudication

Let me share my experience to understand the Denotation of Stamp Duty in Karnataka Context:

- The buyers are husband and wife, both aged 29 years and working for an IT company in Electronic City, Bangalore.

- The sellers are father and son, both are OCI status holders and living in California, USA

- The property is a 3BHK flat in Godrej E-City apartment in Electronic City. The buying price is Rs.1.28 Cr

- The buyer's proposed payment plan is:

Buyers visited the property and within 2 days of the property visit, they decided to proceed with the sale. Buyers paid the down payment of Rs. 1 lakh to confirm deal Sellers shared the following property documents for verification

- Sale deed (of how the sellers acquired the property from builder)

- Tax receipt

- Khata

- ID proof (Aadhaar and PAN)

- Drafted the Sale Agreement in Word document

- We emailed the draft to buyers and sellers for confirmation

- The seller took the printout of the Sale Agreement draft in USA + Father and Son Signed the Sale Agreement on all pages and couriered it to India

- In India, we received the package in 7 working days + Buyers signed the Sale agreement on all pages + Two witnesses signed last page of sale agreement

- The Godrej e-city flat is located in Jayanagar District Jurisdiction; hence we can adjudicate the sale agreement at any sub-registrar office located under Jayanagar District Jurisdiction. Such as Jayanagar, Bommanahalli, Begur, RR Nagar, BTM Layout and some more. I choose to adjudicate in the Jayanagar sub-registrar office.

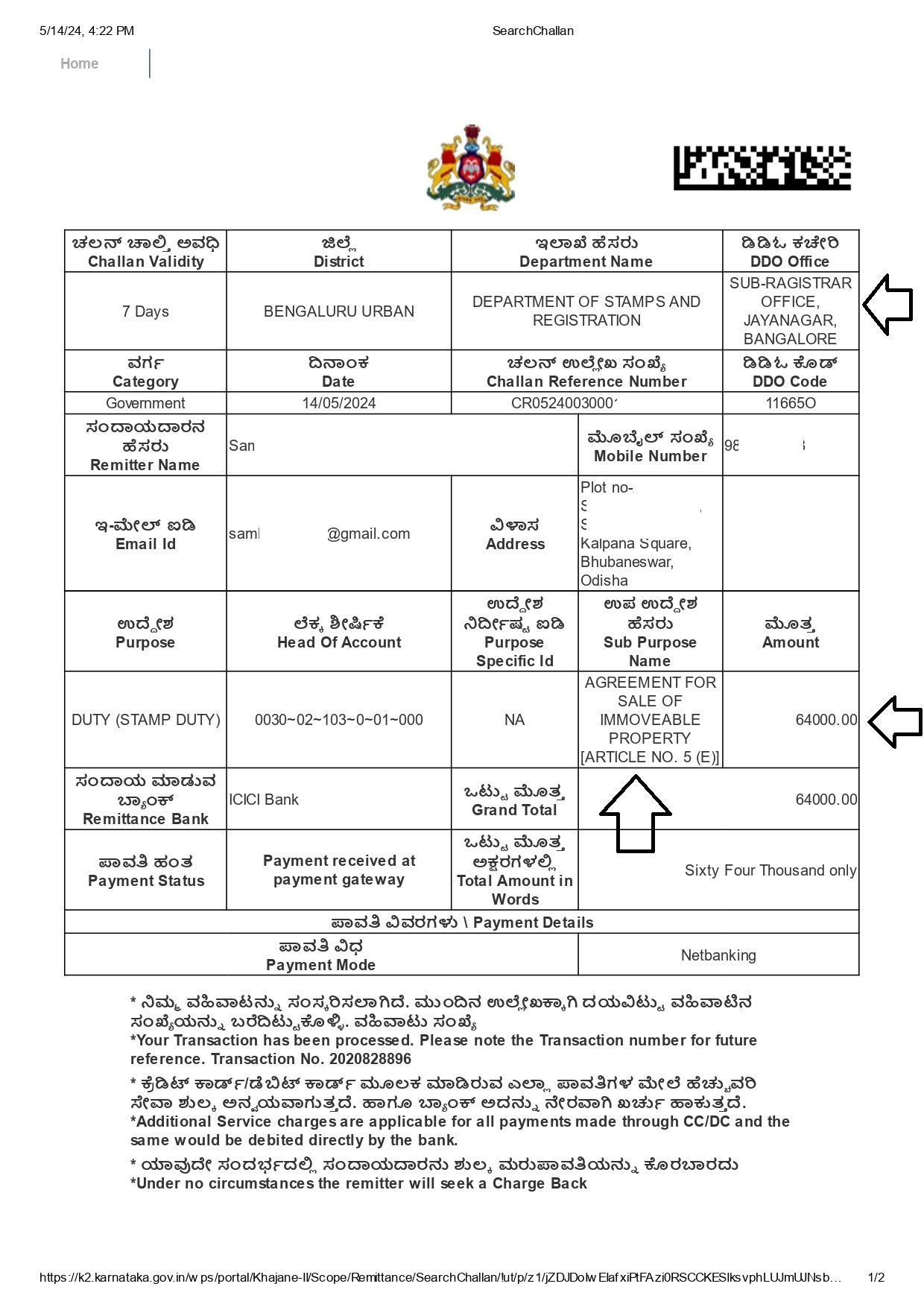

- We must pay Stamp Duty on the Khajane -2 website. The Stamp Duty value is 0.5% of the buying price, that is Rs. 1.28 Cr * 0.5% = 64,000

- Sub-Registrar office

- Purpose

- Stamp Duty amount

To adjudicate the Sale Agreement in sub-registrar office, buyer and seller presence is not mandatory. We don’t need to get an appointment, we can just walk-in with sale agreement and Khajane -2 Challan

In our case, sellers and buyers were not preset, we carried the Sale Agreement and above Khajane-2 Challan to Jayanagar Sub-registrar office.

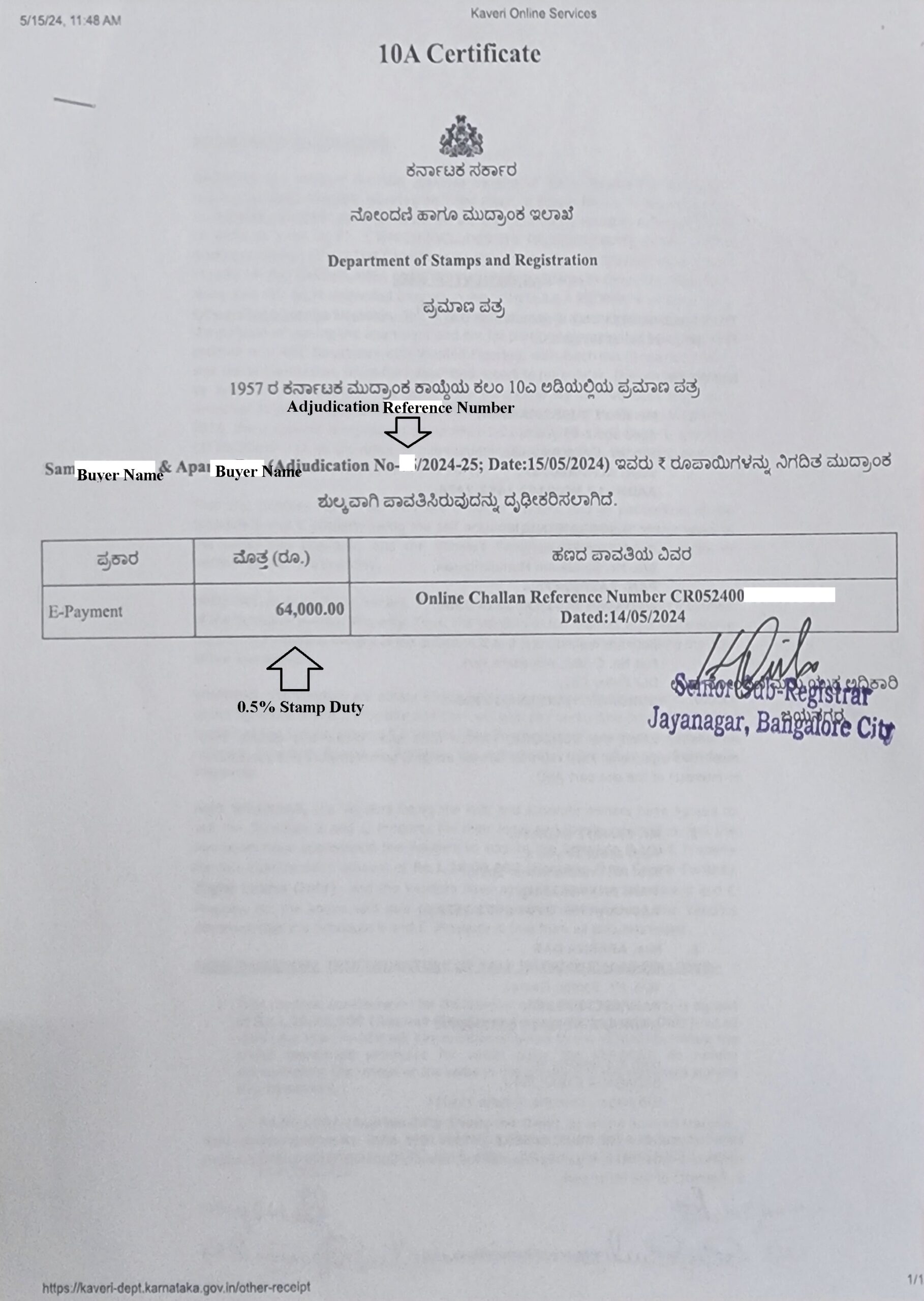

The staff in the sub-registrar office enters the challan number in the computer and prints the adjudication certificate. It took us around 30 minutes to complete adjudication work (productive time is just 5 minutes, rest is the waiting time)

Refer to the below adjudication Certificate, We highlighted 0.5% Stamp Duty of Rs. 64,000 in below image

To adjudicate the Sale Agreement in sub-registrar office, buyer and seller presence is not mandatory. We don’t need to get an appointment, we can just walk-in with sale agreement and Khajane -2 Challan

In our case, sellers and buyers were not preset, we carried the Sale Agreement and above Khajane-2 Challan to Jayanagar Sub-registrar office.

The staff in the sub-registrar office enters the challan number in the computer and prints the adjudication certificate. It took us around 30 minutes to complete adjudication work (productive time is just 5 minutes, rest is the waiting time)

Refer to the below adjudication Certificate, We highlighted 0.5% Stamp Duty of Rs. 64,000 in below image

We would like to mention, why we chose Adjudication for Sale Agreement instead of registration or e-stamp, following are the reasons

We would like to mention, why we chose Adjudication for Sale Agreement instead of registration or e-stamp, following are the reasons

- To register a sale agreement, seller and buyer must present in sub-registrar office but in our context sellers are living in USA. Hence we ruled out the registration option

- If we execute the Sale Agreement in e-stamp paper. it will incur two-way shipment costs and longer lead time.

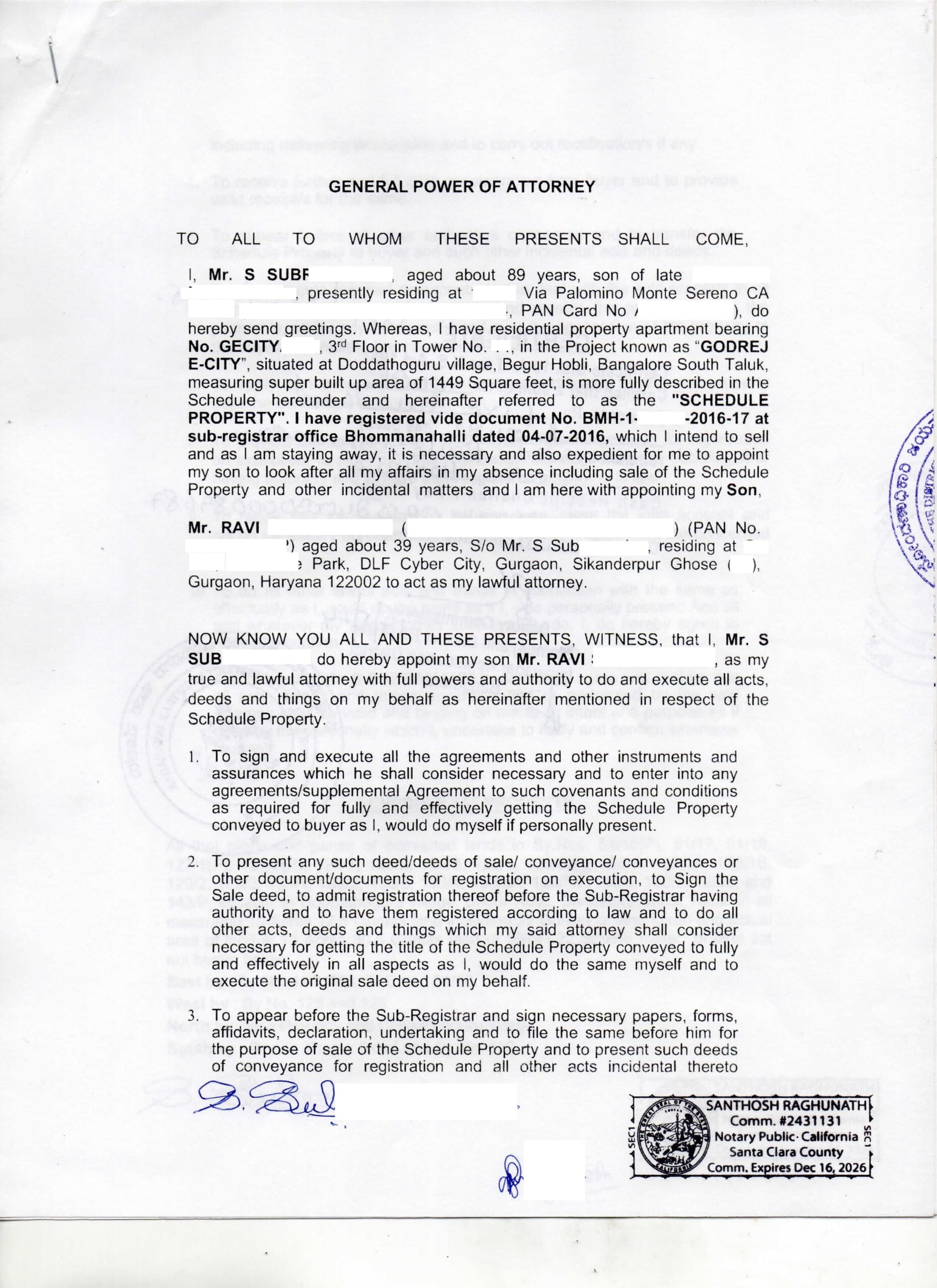

We would like to mention another important factor: Father and son are joint owners. The father is almost 89 years old and he is not in the condition to travel to India, he granted the General Power of Attorney (GPA) to Son to complete the Sale Deed registration in India. When we worked on the above Sale Agreement draft, we worked on GPA draft parallel and emailed it to seller. The seller took the GPA draft prinout in USA, notarized the GPA and couriered the GPA along with the above sale agreement to India In India, when we adjudicated the above Sale Agreement in Jayanagar sub-registrar office, we also adjudicated the GPA in Jayanagar District Registrar office which is located in the same building, just in one go, we completed both Sale Agreement and GPA together. From the above action, our strategy is to avoid multiple international shipments, bring down lead time and bring down overhead cost in adjudication work (as most people execute GPA just before sale deed registration and spend additional shipment cost for only GPA transit, whereas we club all international transit in one package) Refer to our below GPA image:

The buyer applied for home loan in State Bank of India, Koramangala. The Bank representative demanded the following documents

- Application form

- Income proof (Last three-month salary slip)

- ID proofs

- Sale Agreement (which we executed above)

- Seller’s property documents (Sale Deed, Tax receipt, Khata and Encumbrance Certificate)

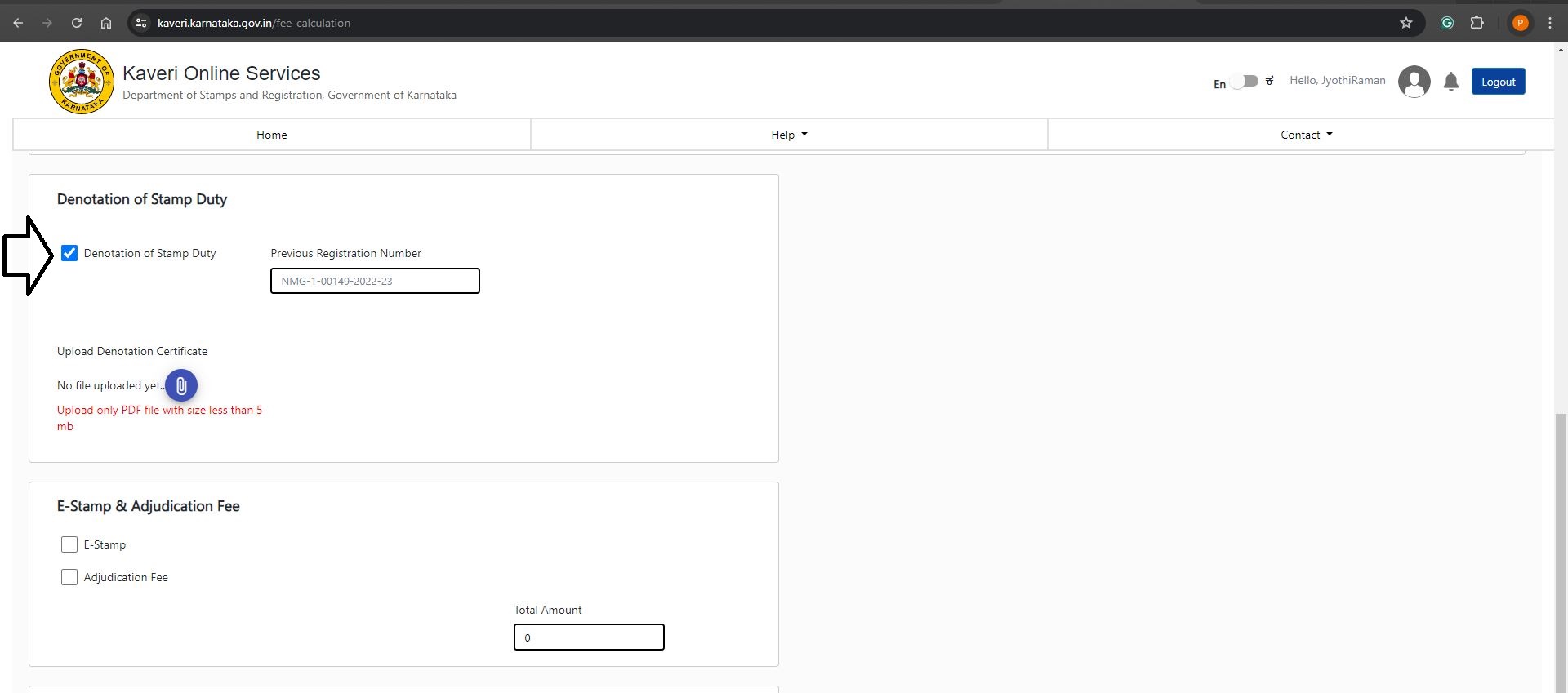

To register the Sale Deed, we need to apply on Kaveri Online Services website, the application process is quite lengthy which includes property search, Schedule, Executant, Identifiers and calculation. The Denotation of Stamp Duty is part of the whole application process. We are going to cover only the Denotation of Stamp Duty below Click on “Denotation of Stamp Duty”. Refer to the below image

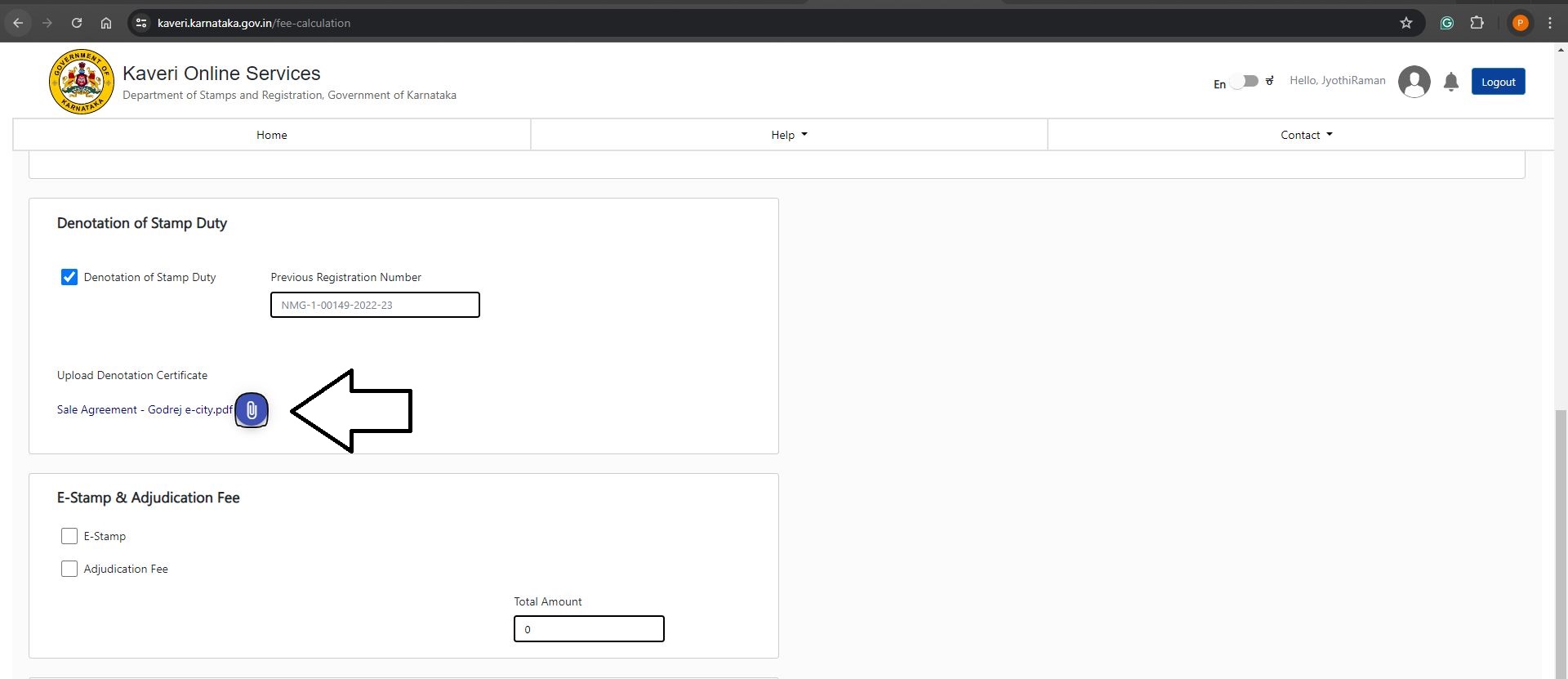

Upload the Adjudication certificate, I uploaded all 7 pages of my Sale Agreement, including the Adjudication Certificate in a PDF less than 5 Mb. Refer to the below image

Upload the Adjudication certificate, I uploaded all 7 pages of my Sale Agreement, including the Adjudication Certificate in a PDF less than 5 Mb. Refer to the below image

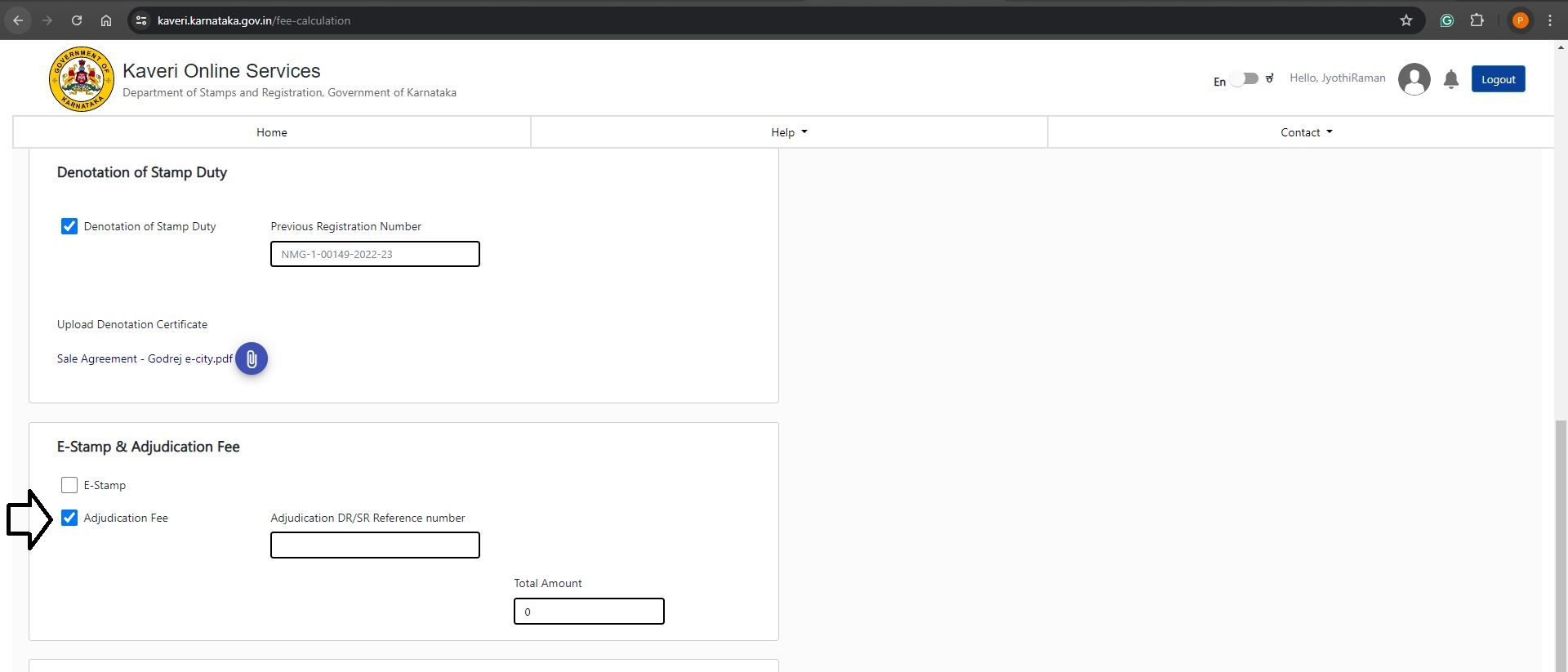

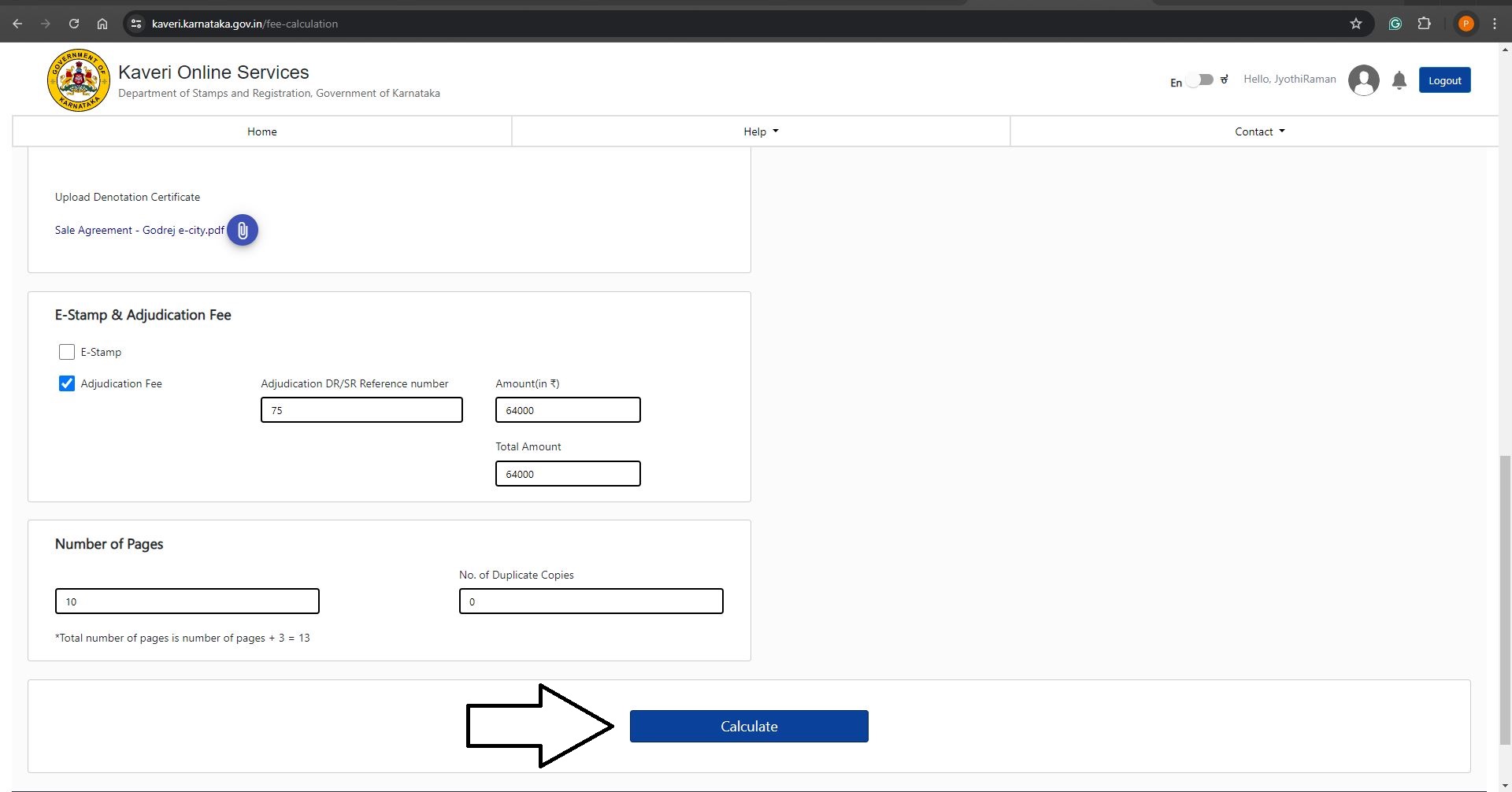

As mentioned above, we paid the Stamp Duty of Rs. 64,000 through Adjudication, we selected adjudication in the given options. (if you paid the Stamp Duty through e-stamp or registration, please select your option). Refer to the below image

As mentioned above, we paid the Stamp Duty of Rs. 64,000 through Adjudication, we selected adjudication in the given options. (if you paid the Stamp Duty through e-stamp or registration, please select your option). Refer to the below image

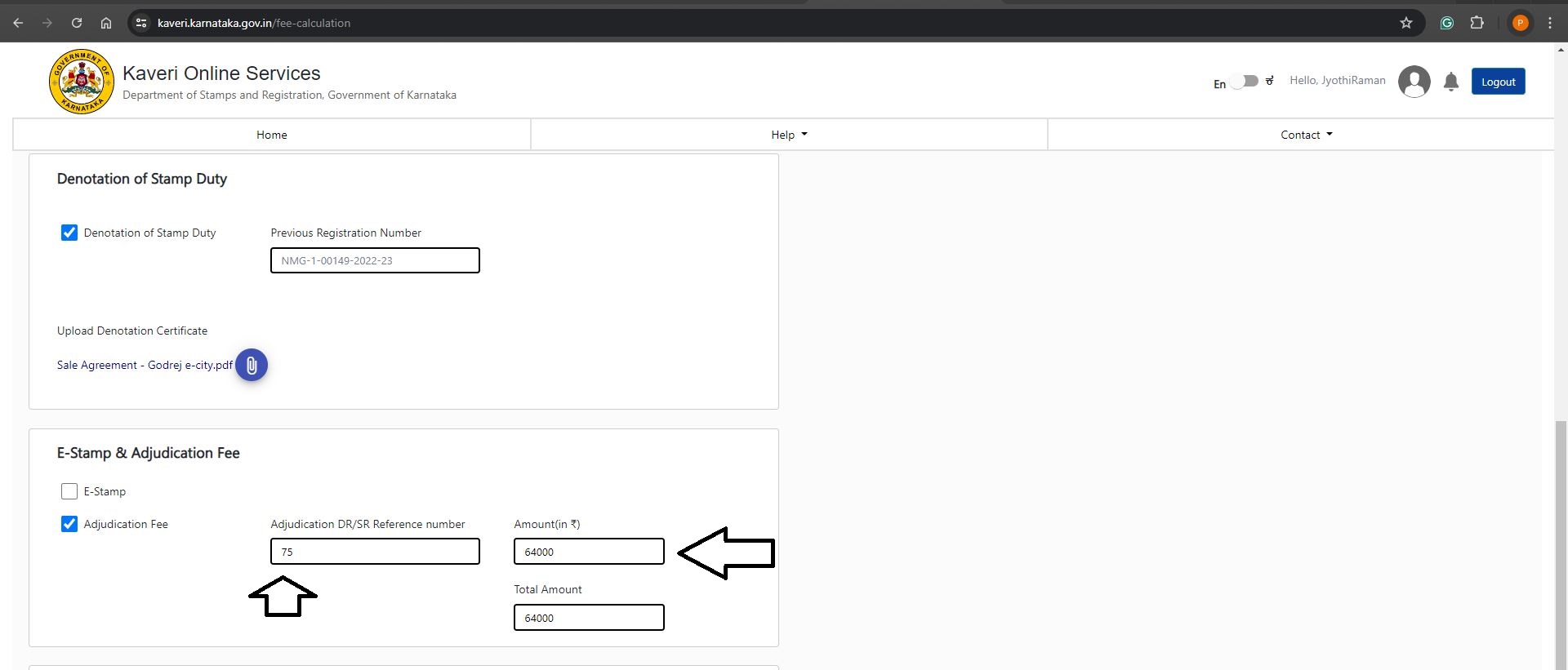

Entered “Adjudication Reference number”, we can locate the adjudication reference number in the Adjudication certificate and we highlighted my adjudication reference number in the above adjudication certificate for your reference. Entered the amount of Rs.64,000. Refer to the below image

Entered “Adjudication Reference number”, we can locate the adjudication reference number in the Adjudication certificate and we highlighted my adjudication reference number in the above adjudication certificate for your reference. Entered the amount of Rs.64,000. Refer to the below image

Click on Calculate, refer to the below image

Click on Calculate, refer to the below image

This completes the procedure to apply for Denotation of Stamp Duty, further I would like to share my ground experience

This completes the procedure to apply for Denotation of Stamp Duty, further I would like to share my ground experience

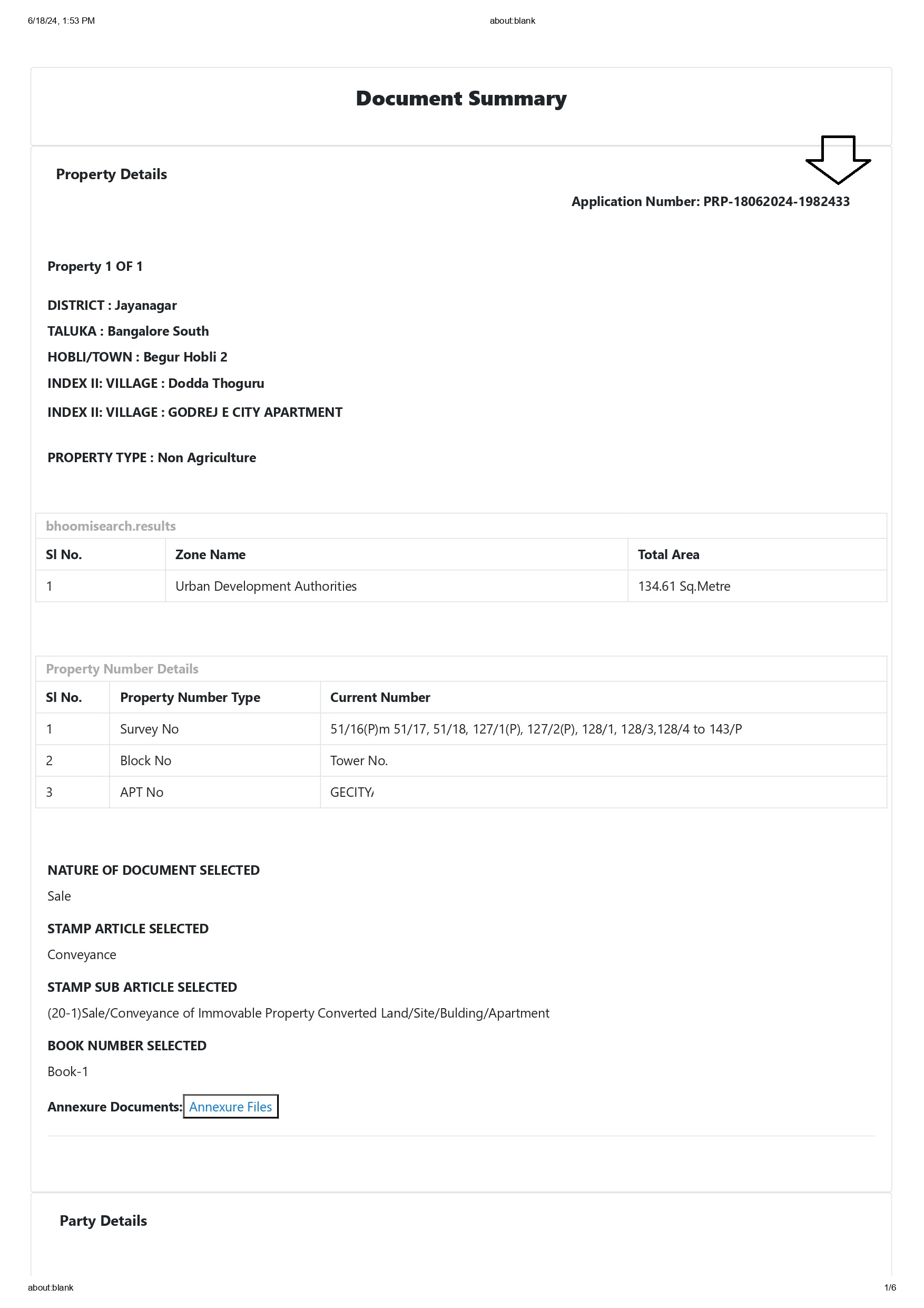

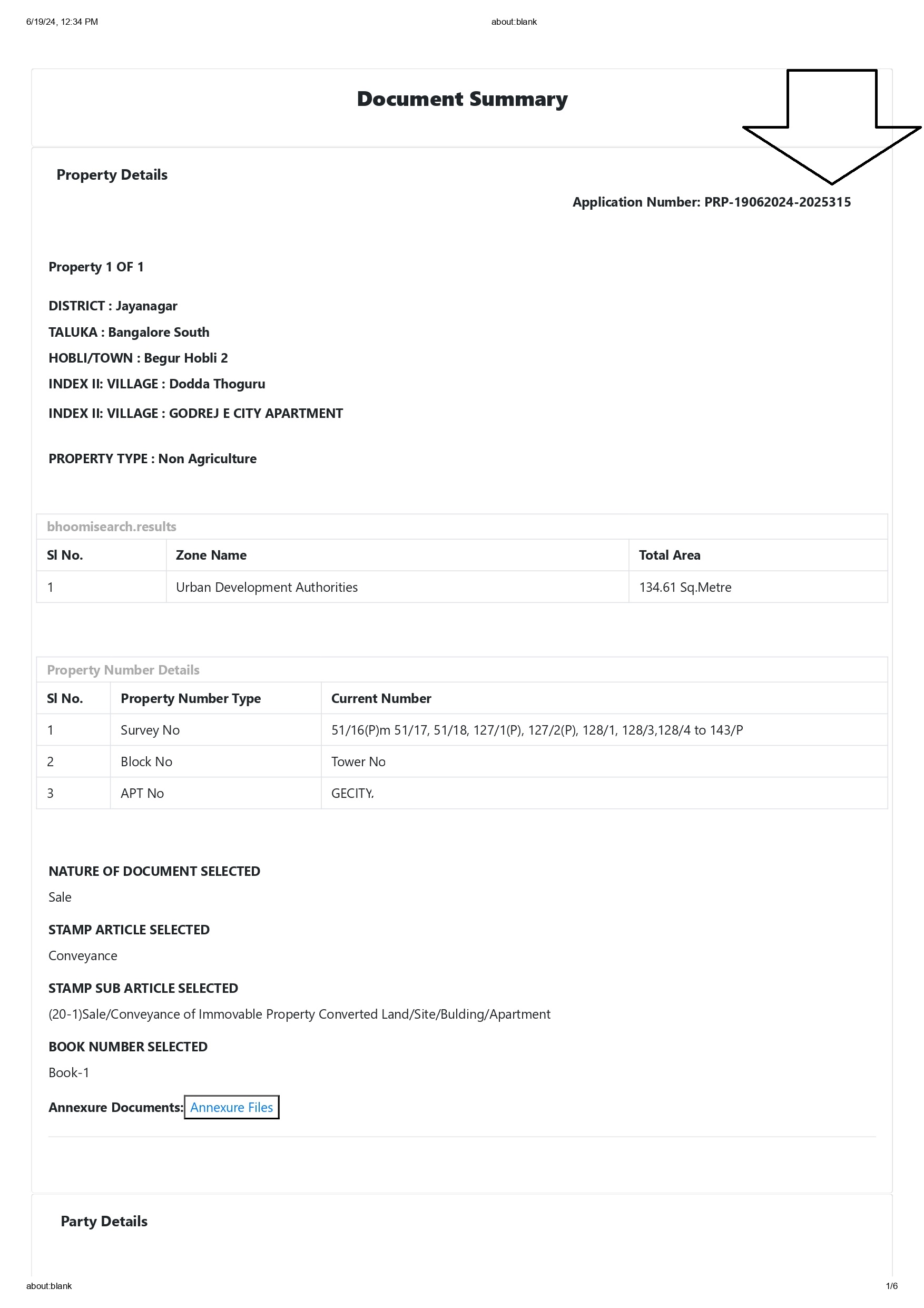

After submitting our application to Kaveri Online Services, we downloaded the summary report, my application number ends with 433 and we highlighted the application number below for our reference

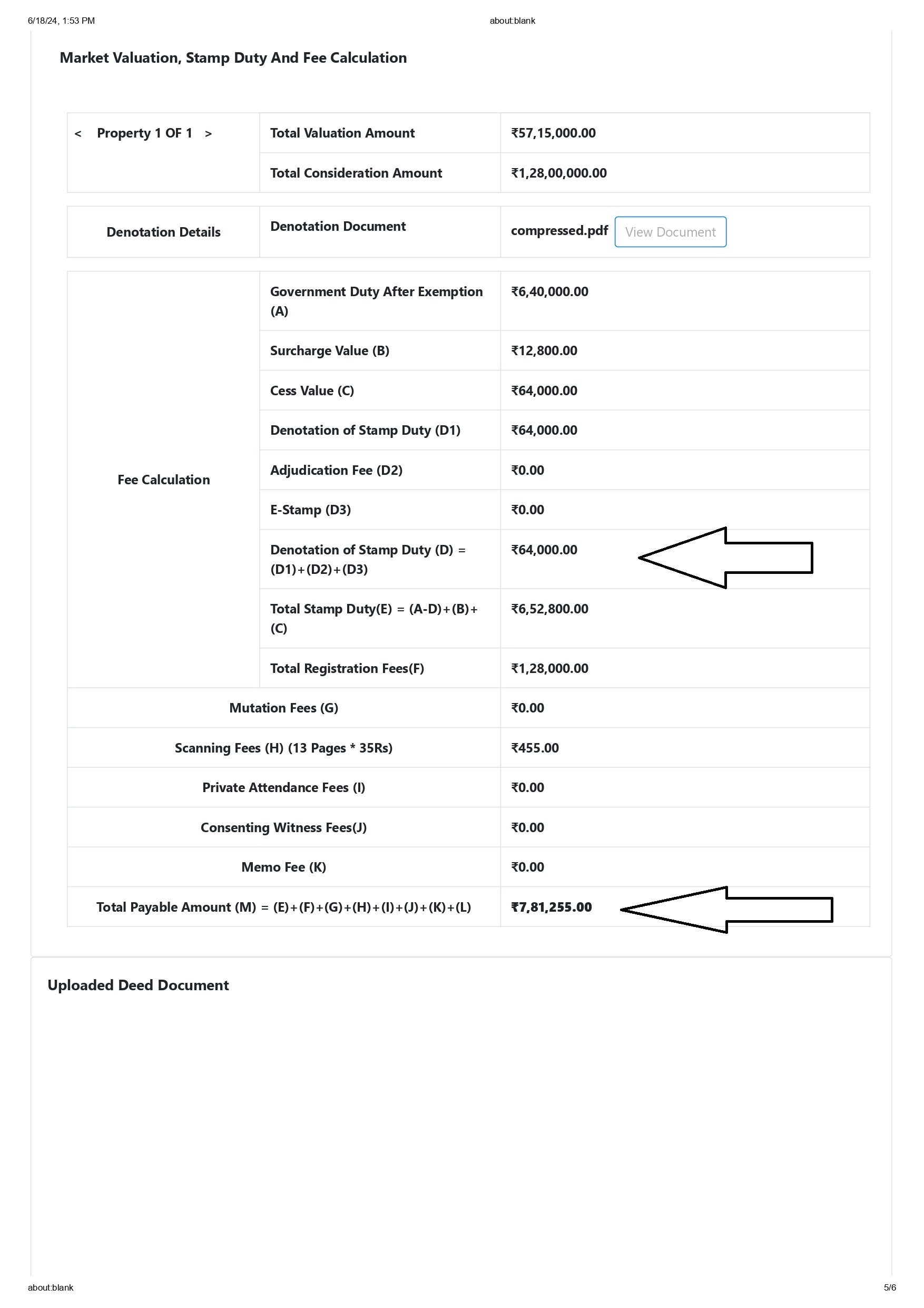

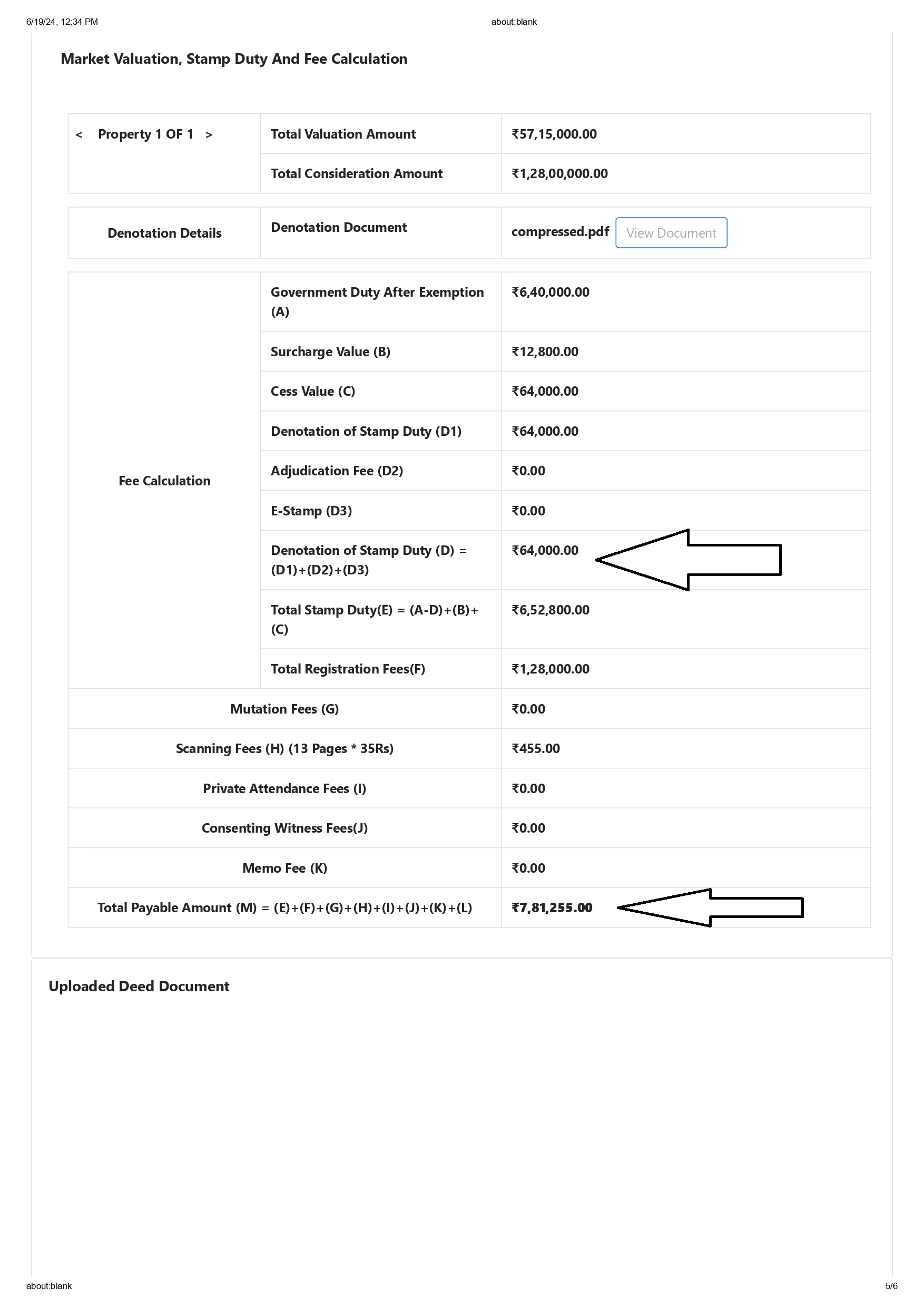

Below is the calculation from my summary report, we highlighted the denotation of Stamp Duty Rs. 64,000 which means we have opted for denotation in this application. My total payable amount is Rs. 7,81,255 including stamp duty & Registration Fee. We highlighted below

Below is the calculation from my summary report, we highlighted the denotation of Stamp Duty Rs. 64,000 which means we have opted for denotation in this application. My total payable amount is Rs. 7,81,255 including stamp duty & Registration Fee. We highlighted below

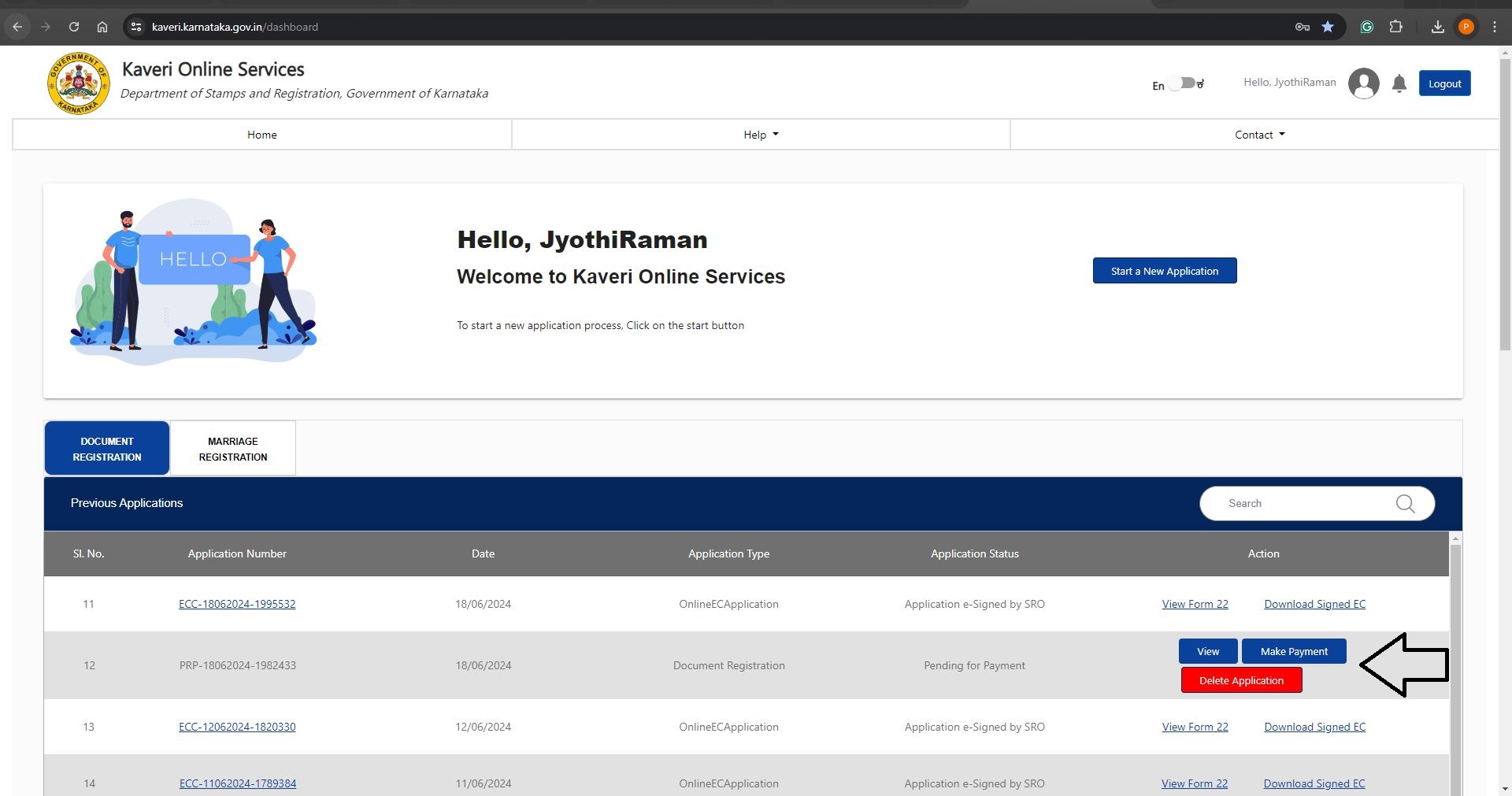

The next day, our application was approved and we received Make Payment. Refer to the below image

The next day, our application was approved and we received Make Payment. Refer to the below image

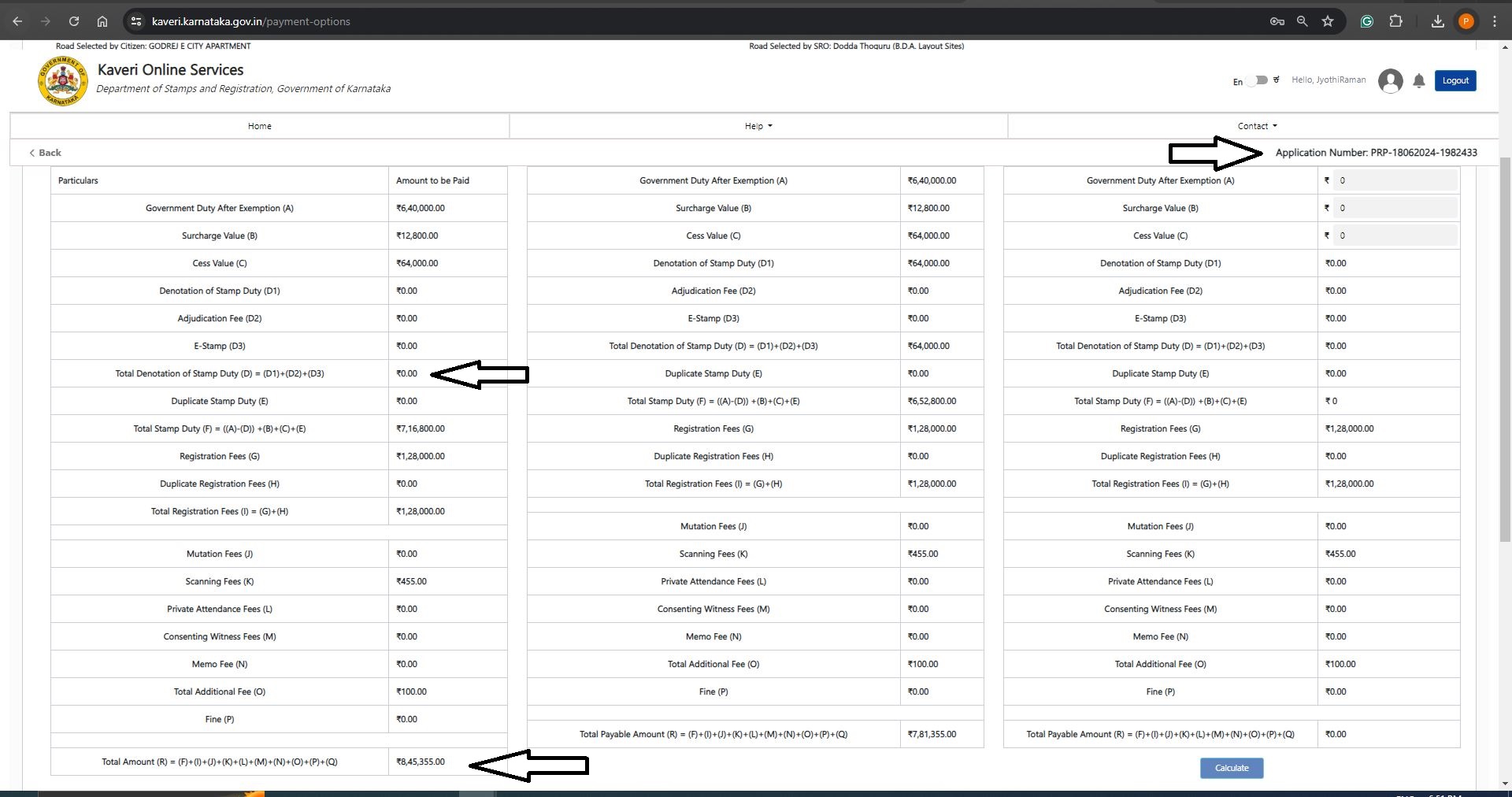

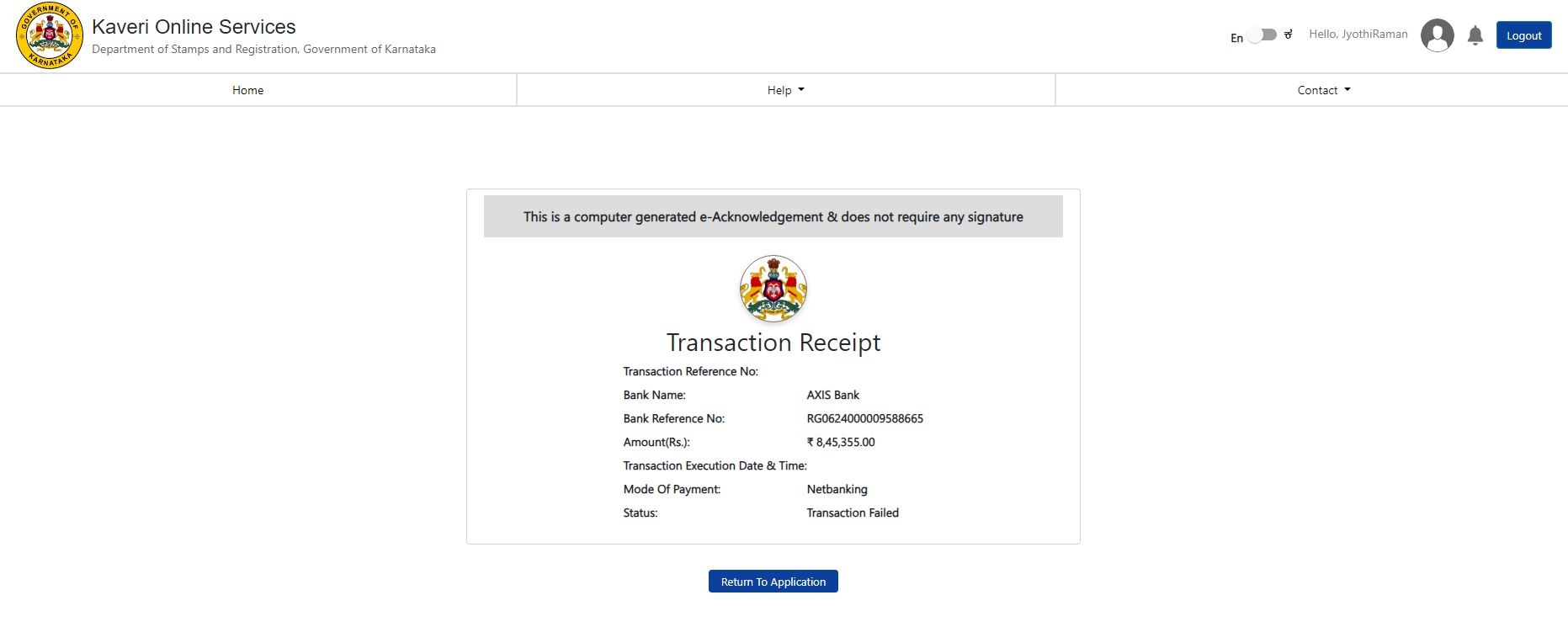

We clicked on Make payment and noticed that the denotation of Rs. 64,000 was missing. The total payable amount is showing as Rs. 8,45,355 instead of Rs. 7,81,255 as mentioned in above summary report

In the below screenshot, we highlighted our application number ending with 433, missing Denotation and total payable amount of Rs. 8,45,355

We clicked on Make payment and noticed that the denotation of Rs. 64,000 was missing. The total payable amount is showing as Rs. 8,45,355 instead of Rs. 7,81,255 as mentioned in above summary report

In the below screenshot, we highlighted our application number ending with 433, missing Denotation and total payable amount of Rs. 8,45,355

We submitted the above application to RR Nagar sub-registrar office; we went to the RR Nagar sub-registrar office for clarification. We explained the missing denotation to the officer, the officer said that the denotation was not displaying on his computer screen so he was not able to provide denotation

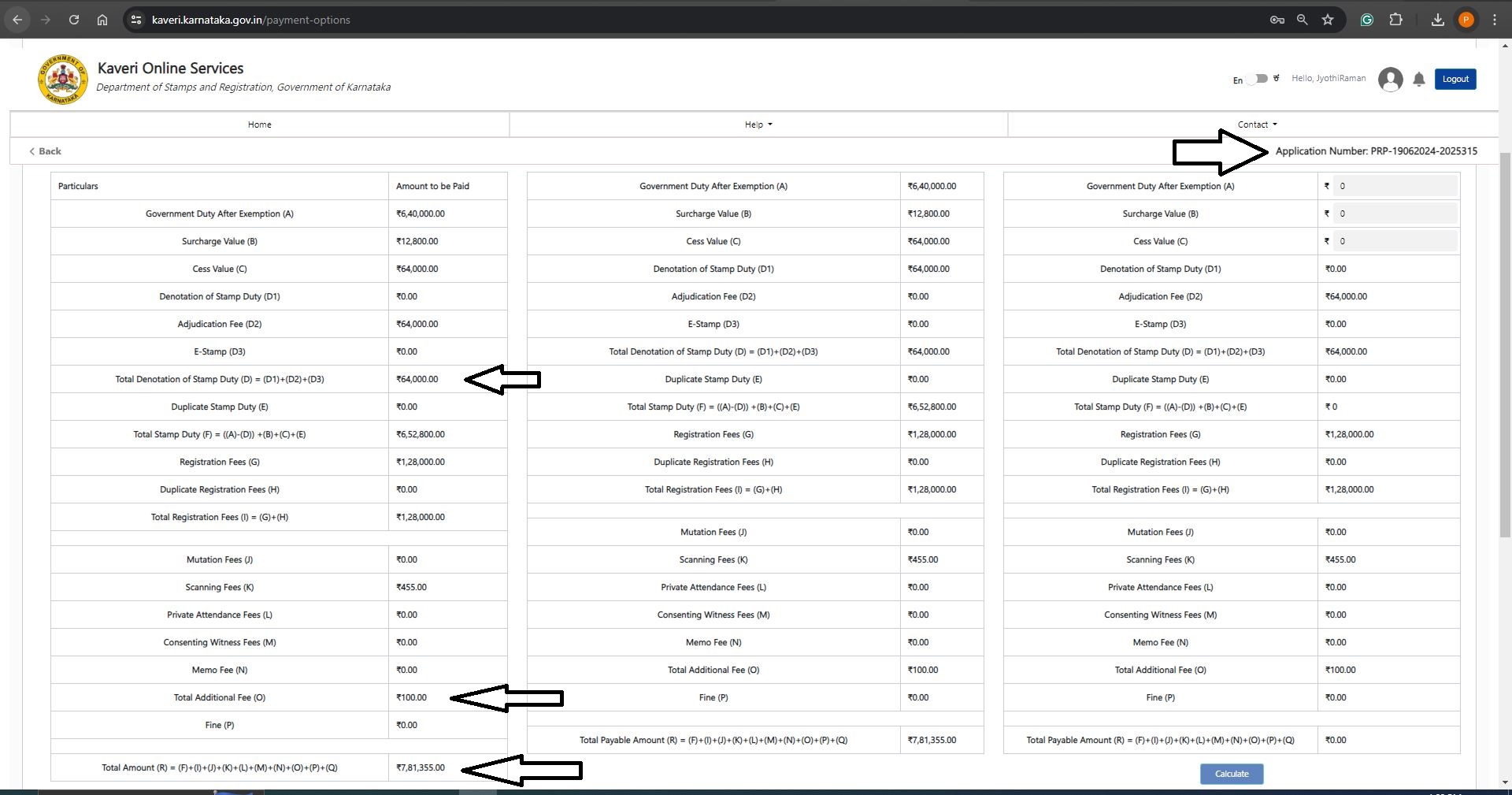

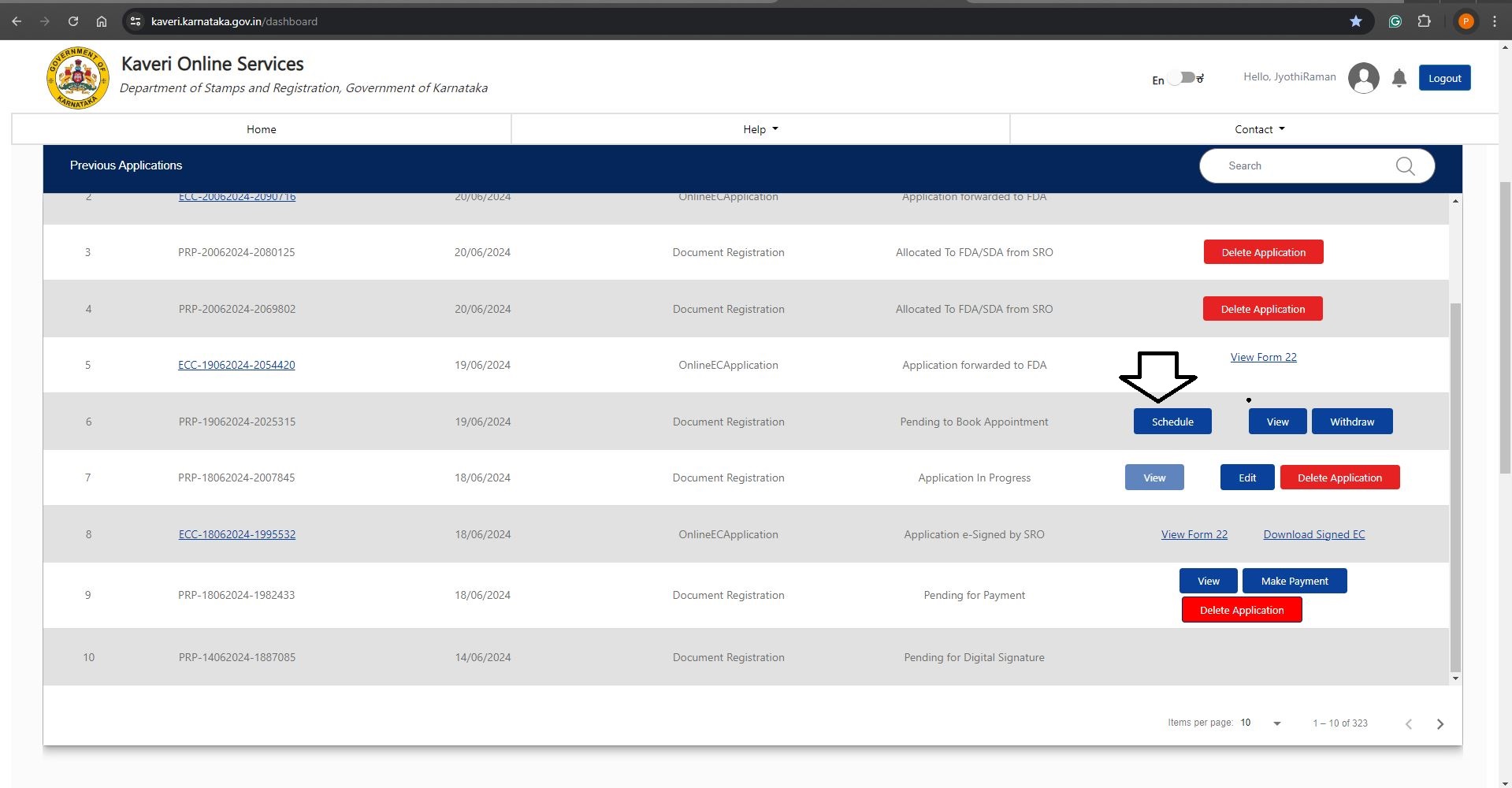

Since our application is already approved, the officer cannot edit our existing application. The officer told me to refile a new application with Denotation and share the summary report & copy of the Adjudication certificate. Accordingly, we refiled the new application and our new application number ends with 315. Refer to new application number in below image for your reference

We submitted the above application to RR Nagar sub-registrar office; we went to the RR Nagar sub-registrar office for clarification. We explained the missing denotation to the officer, the officer said that the denotation was not displaying on his computer screen so he was not able to provide denotation

Since our application is already approved, the officer cannot edit our existing application. The officer told me to refile a new application with Denotation and share the summary report & copy of the Adjudication certificate. Accordingly, we refiled the new application and our new application number ends with 315. Refer to new application number in below image for your reference

Below is the calculation from summary report, we highlighted the Denotation of Stamp Duty Rs.64,000 which means we opted for denotation in new application and we highlighted total payable amount of Rs. 7,81,255 for your reference

Below is the calculation from summary report, we highlighted the Denotation of Stamp Duty Rs.64,000 which means we opted for denotation in new application and we highlighted total payable amount of Rs. 7,81,255 for your reference

We took printout of summary report and adjudication certificate. We went to RR Nagar sub-registrar office and politely requested the officer to provide the Denotation and approve the new application. The officer verified the documents, provided the Denotation of Rs. 64,000 and approved our new application.

Below is the calculation after approval. We highlighted the new application number ending with 315, Denotation of Stamp Duty Rs.64,000 and the total amount of Rs. 7,81,355 instead of Rs. 7,81,255 (I was charged Rs. 100 as an additional fee. I think, this fee is for an affidavit which they add for every Sale Deed registration, we highlighted in below image)

We took printout of summary report and adjudication certificate. We went to RR Nagar sub-registrar office and politely requested the officer to provide the Denotation and approve the new application. The officer verified the documents, provided the Denotation of Rs. 64,000 and approved our new application.

Below is the calculation after approval. We highlighted the new application number ending with 315, Denotation of Stamp Duty Rs.64,000 and the total amount of Rs. 7,81,355 instead of Rs. 7,81,255 (I was charged Rs. 100 as an additional fee. I think, this fee is for an affidavit which they add for every Sale Deed registration, we highlighted in below image)

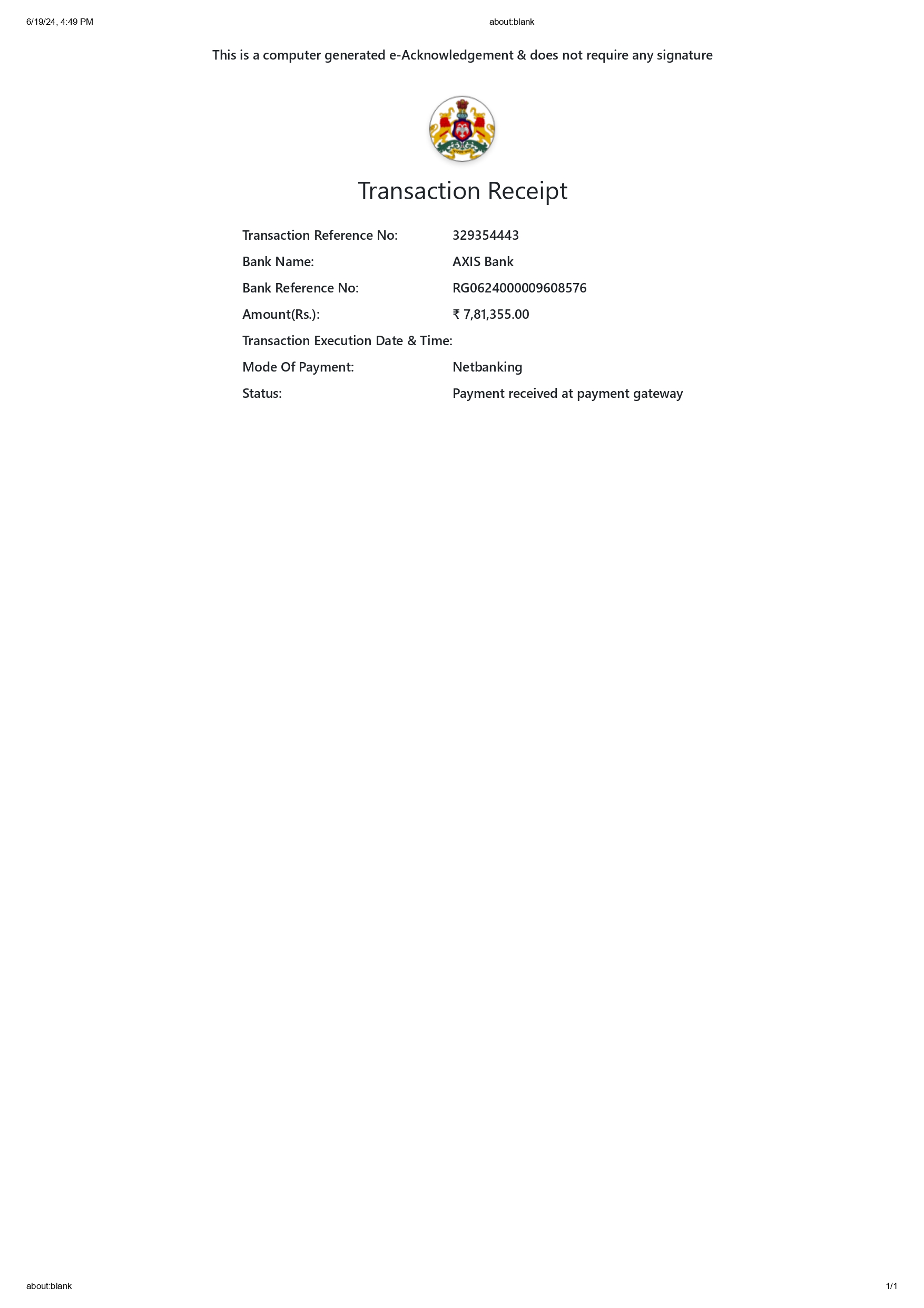

We paid the total amount of Rs. 7,81,355 through Internet banking. Refer to our below transaction receipt

We paid the total amount of Rs. 7,81,355 through Internet banking. Refer to our below transaction receipt

We clicked on Schedule to book our registration slot. Refer to below image

We clicked on Schedule to book our registration slot. Refer to below image

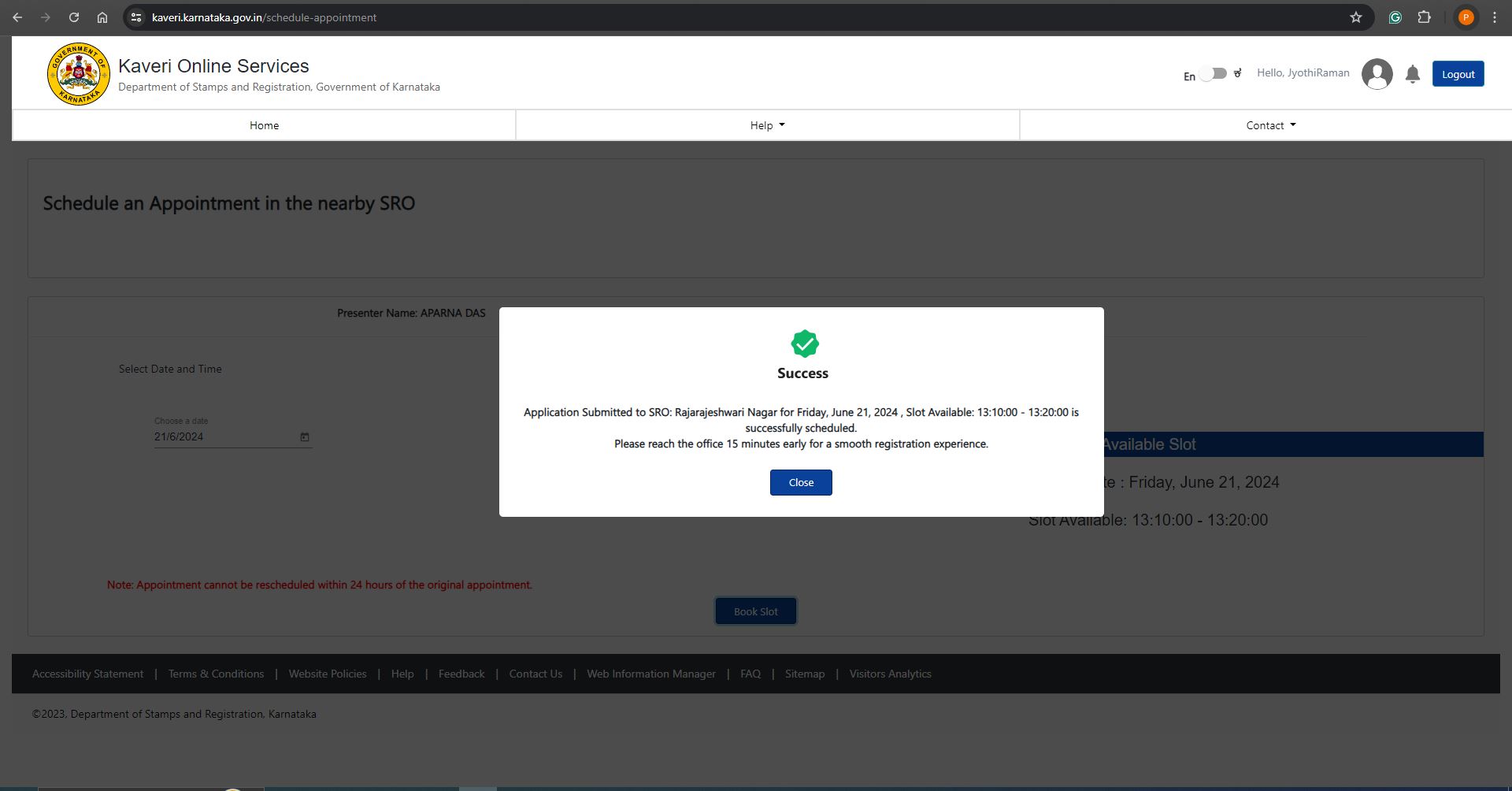

Refer to the below slot confirmation

Refer to the below slot confirmation

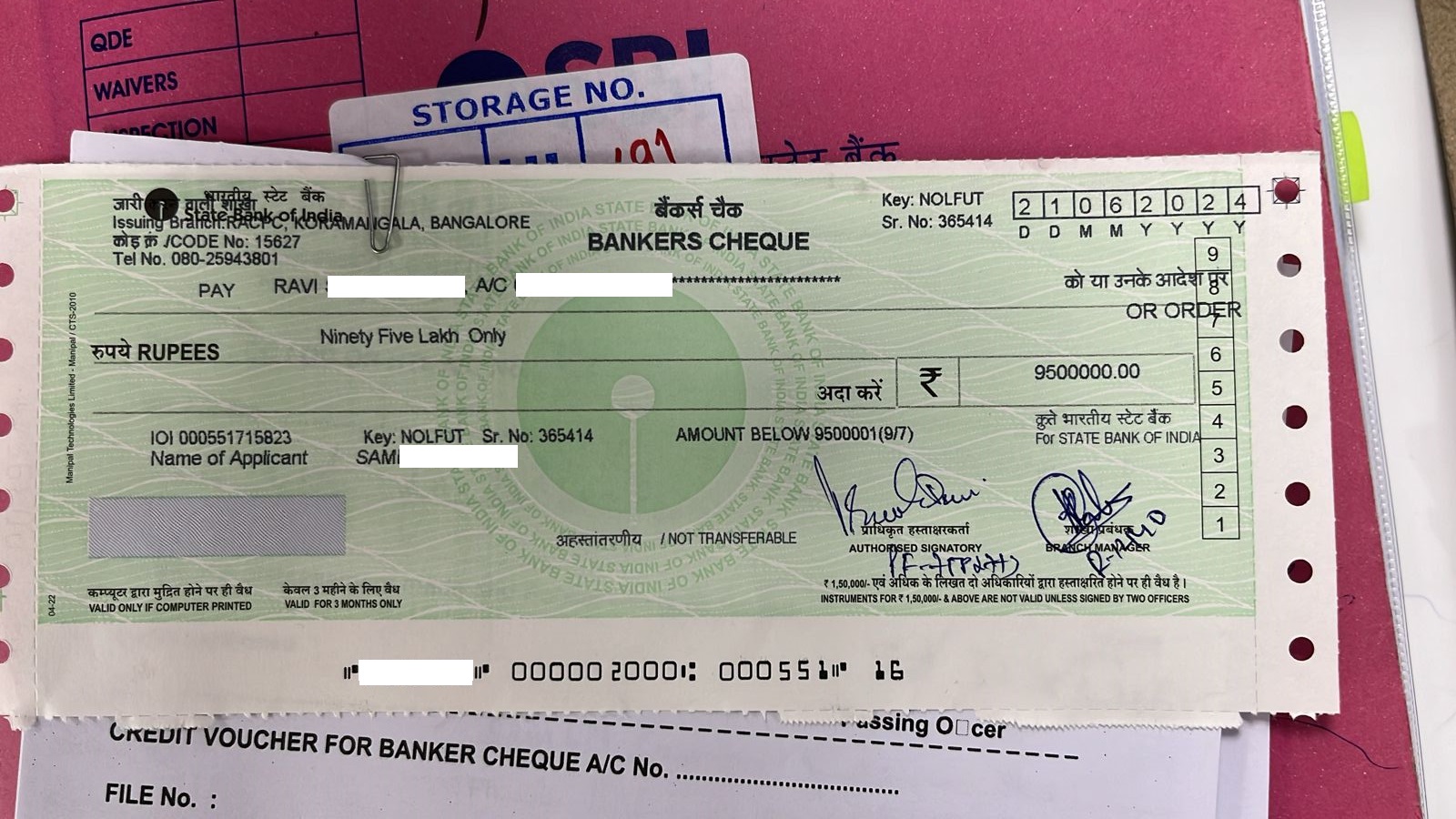

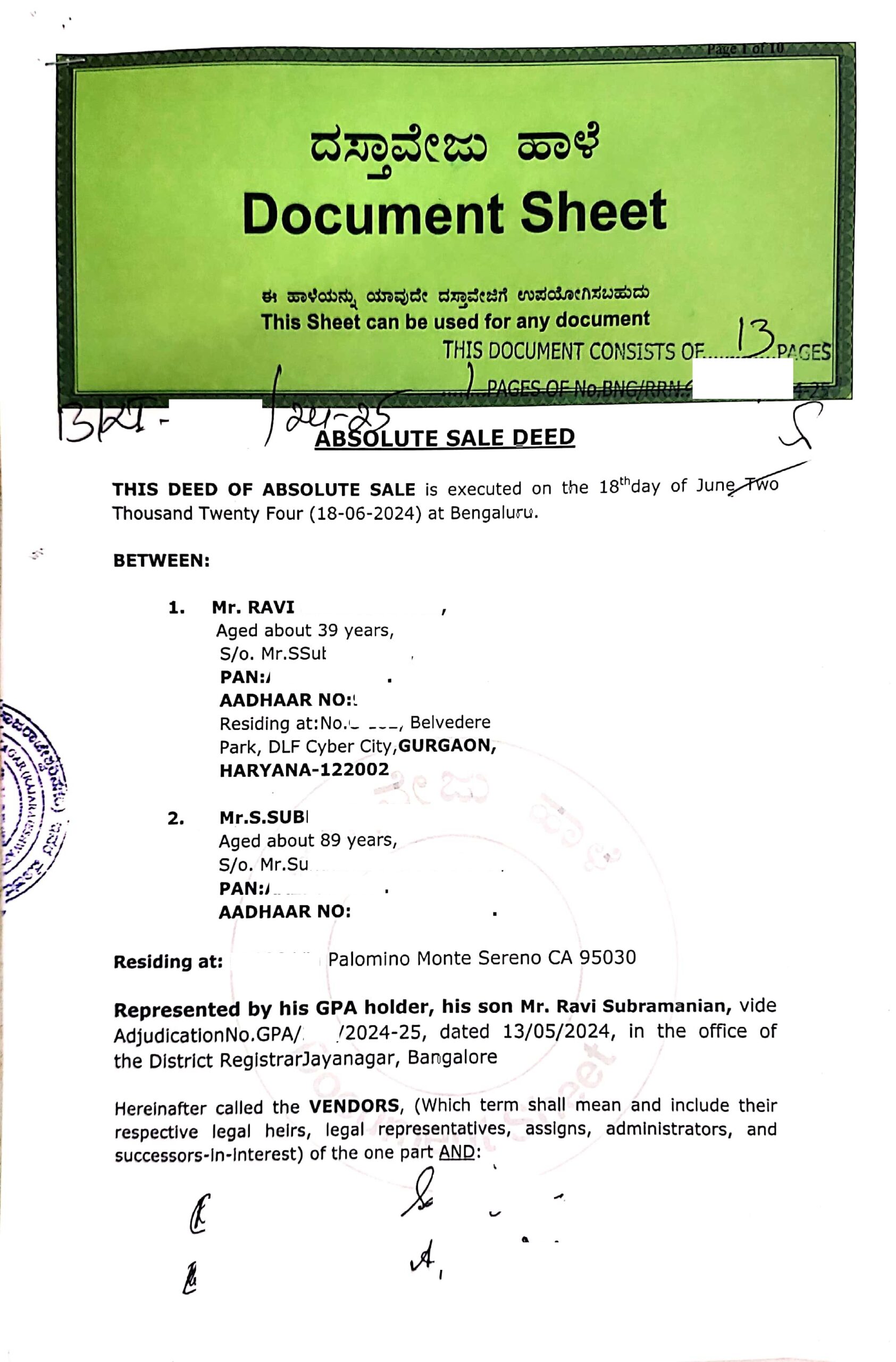

The seller from the USA reached Bangalore on 20th June 2024 and we completed the Deed registration on 21st June 2024. The seller collected the final settlement cheque on the same day from SBI. Below is our registered Sale Deed

Note:

- Although we provide Denotaton in application, we should make sure that denotation is reflected after approval

- Before we make the payment, it is important to cross-verify the calculation provided by sub-registrar,

- Denotation is a big amount, we must utilize it without missing

For consultation, please write to us pgnproperties@gmail.com or WhatsApp +91-97424-79020 Thank you for reading…