Below are few important documents to check:

- Mother deed

- Sale deed

- Encumbrance certificate

- Tax paid receipt

- ekhata

- Occupancy certificate

- No objection certificate from seller’s bank and Registered Discharge Deed

- No objection certificate from apartment society

- Floor plan

- Seller’s PAN & Aadhaar

- Cancelled cheque from seller

Let me explain in detail

- Mother Deed:

“Mother deed traces history of ownership”

Ownership of property changes hands through a series of transactions like sale, gift, partition, release, inherited, court order, etc...

Each change of ownership has to be traced with help of transfer document. The sequence should be in chronological order, continuous and unbroken. Any missing link has to be carefully scrutinized by referring to the records at registering offices (by obtaining certified copy)

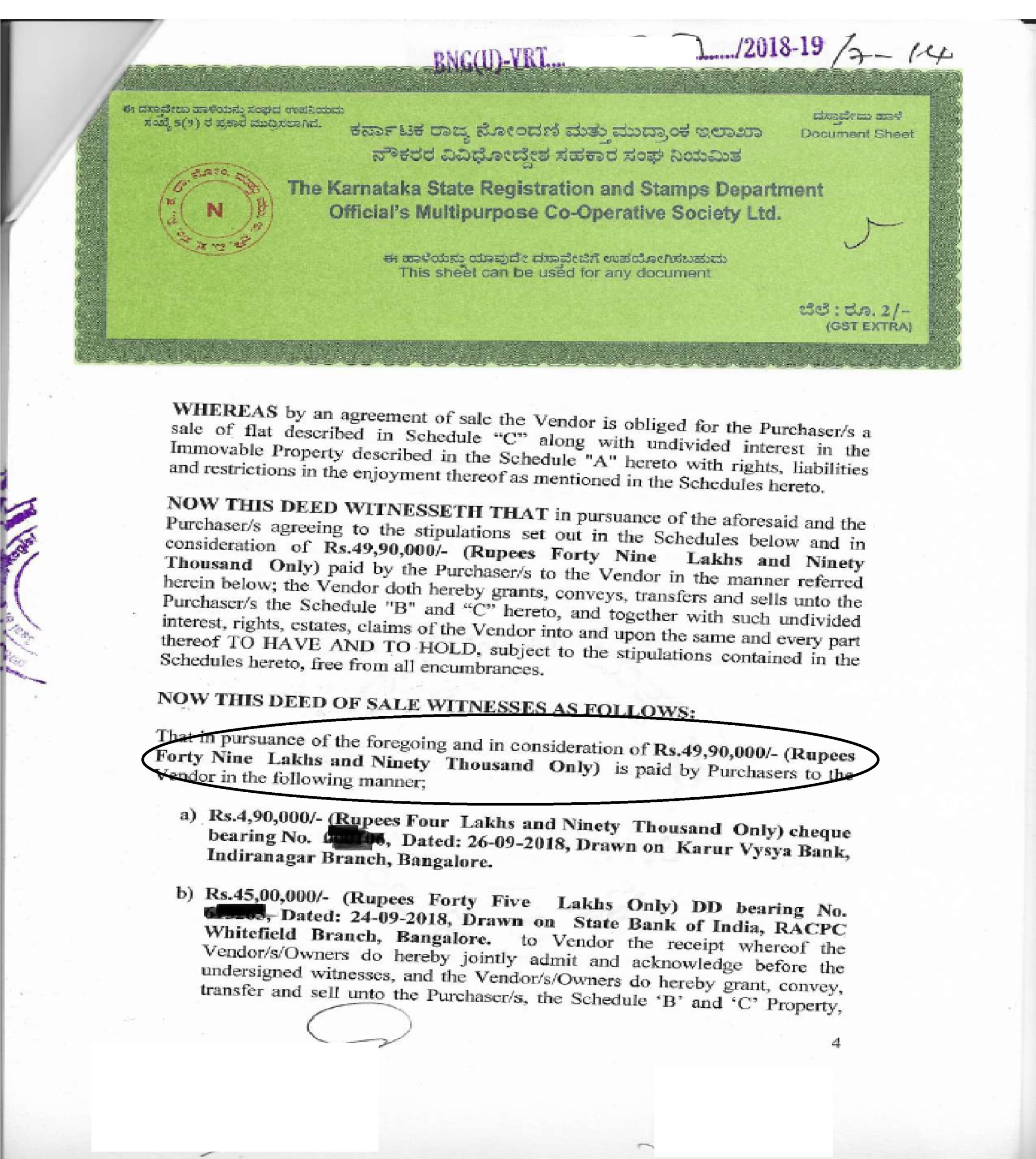

2. Sale Deed:

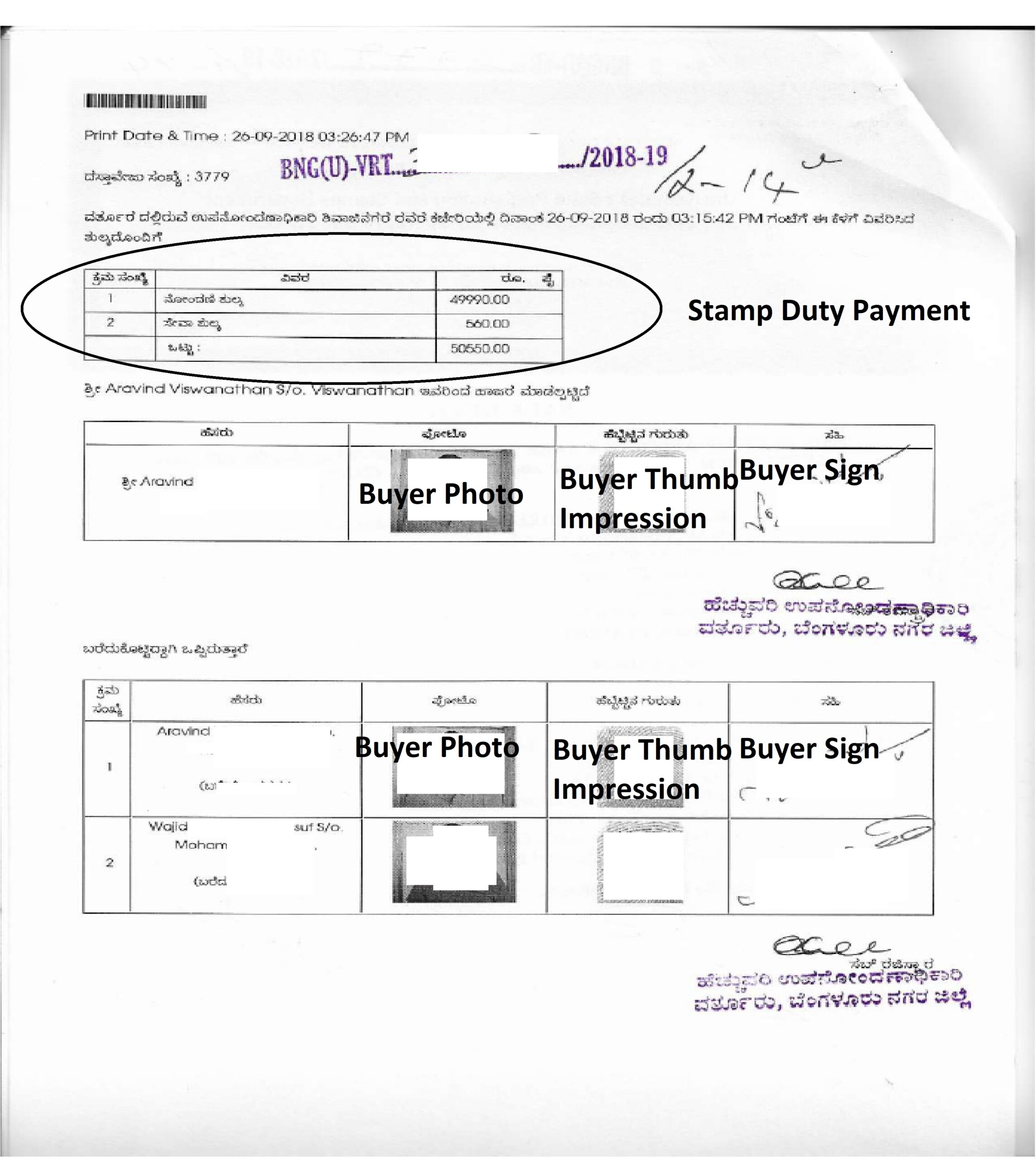

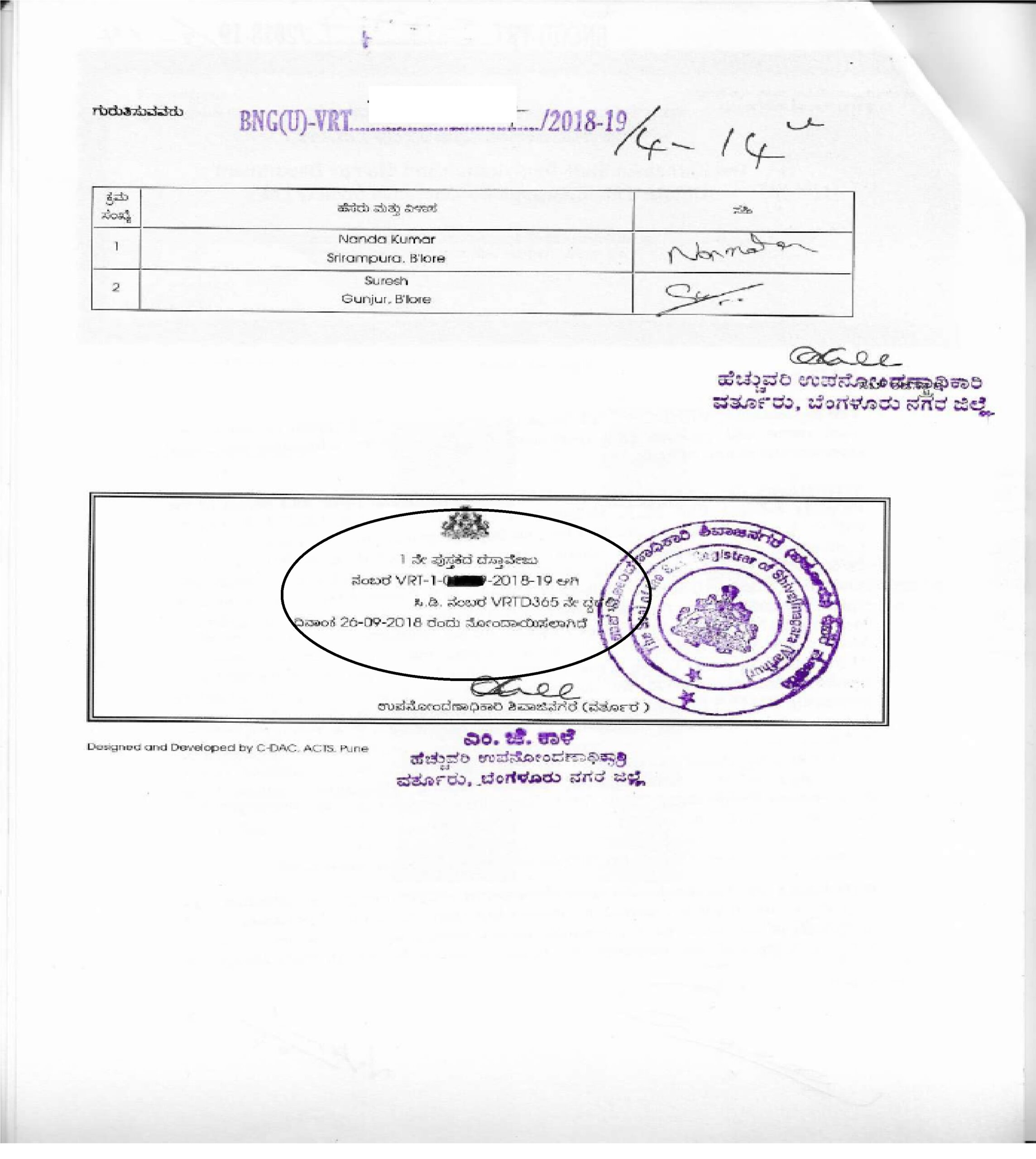

“Sale deed traces the current ownership”. Verify following information in registered Sale deed

- Buyer name, address, PAN number, we encircled this information in below mock sale deed.

- Stamp Duty payment, Buyer photo, thumb impression and signature

- Registration number

- Consideration value (Price)

- Property Schedule

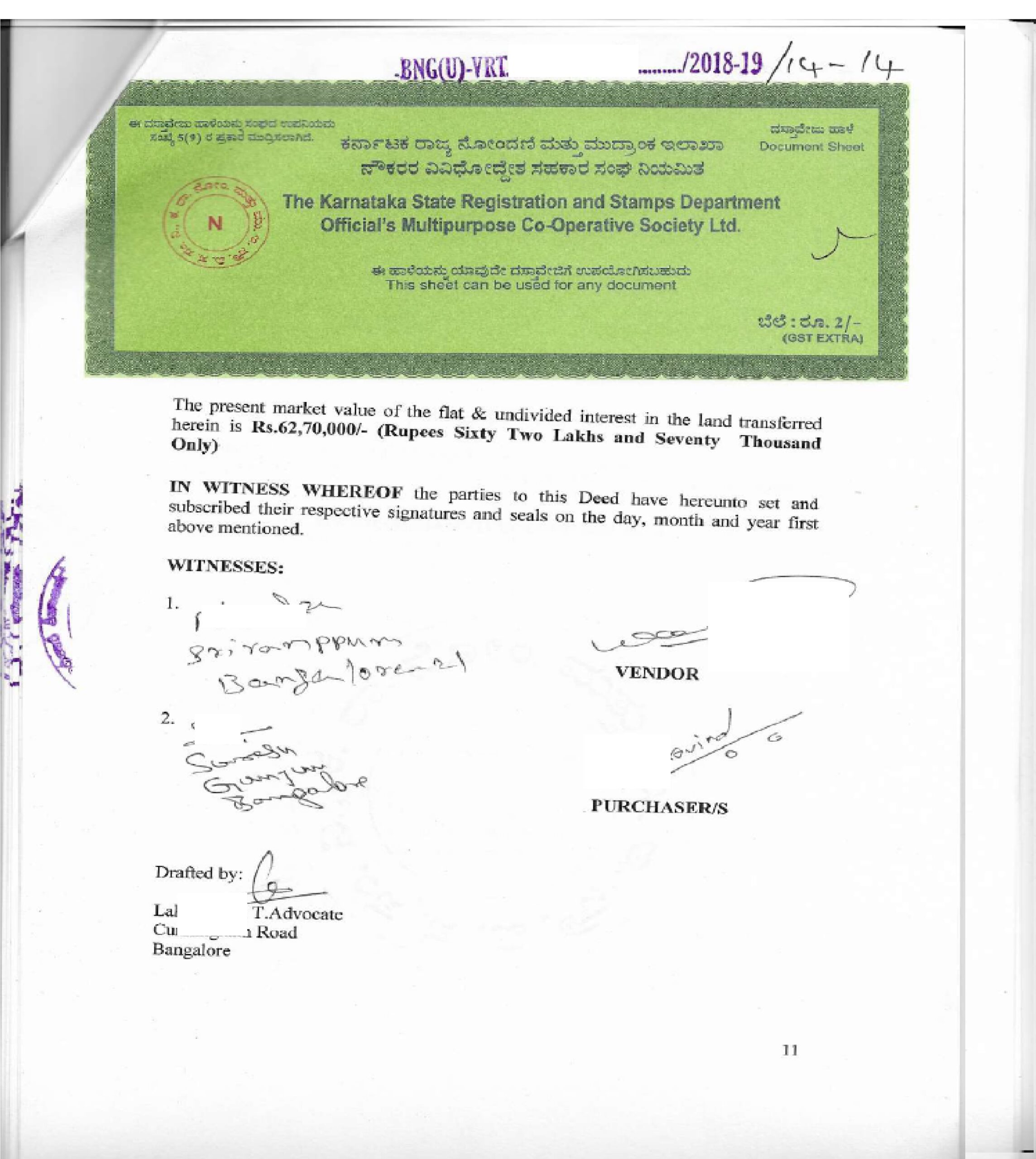

- Seller, buyer and witness signature

Apart from the above verification, extract certified copy of sale deed from registrar's office, this helps us to check the authenticity of sale deed provided by seller.

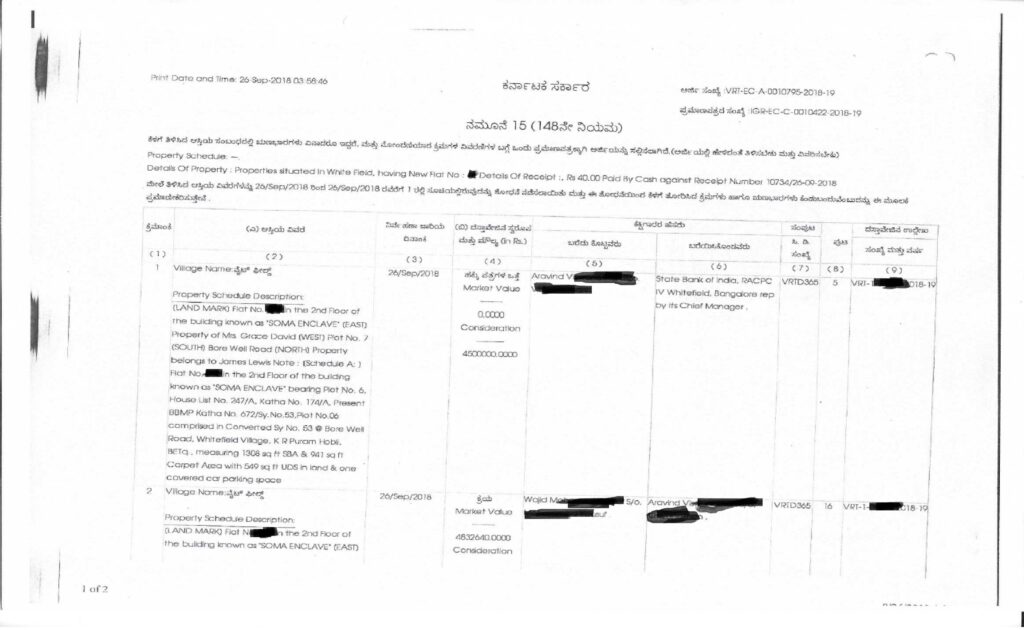

3. Encumbrance certificate (EC):

Based on the sale deed provided by seller, extract EC online or sub-registrar office

An EC provides information about seller name, buyer name, type of deed, property schedule, buying price, registration date and registration number.

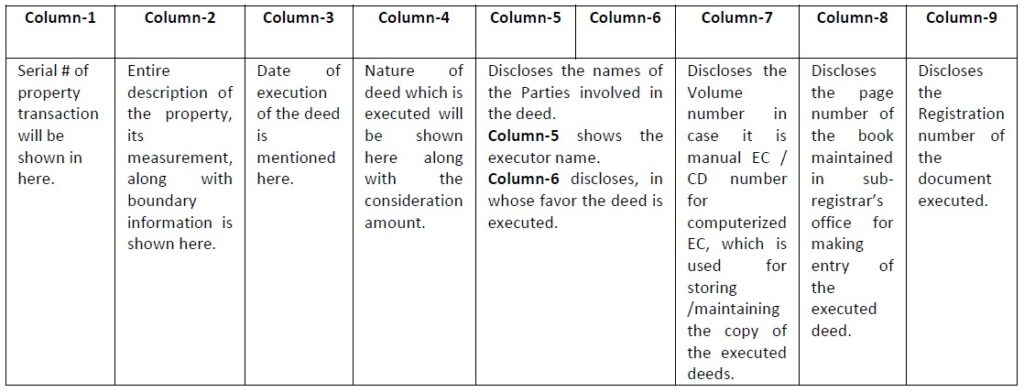

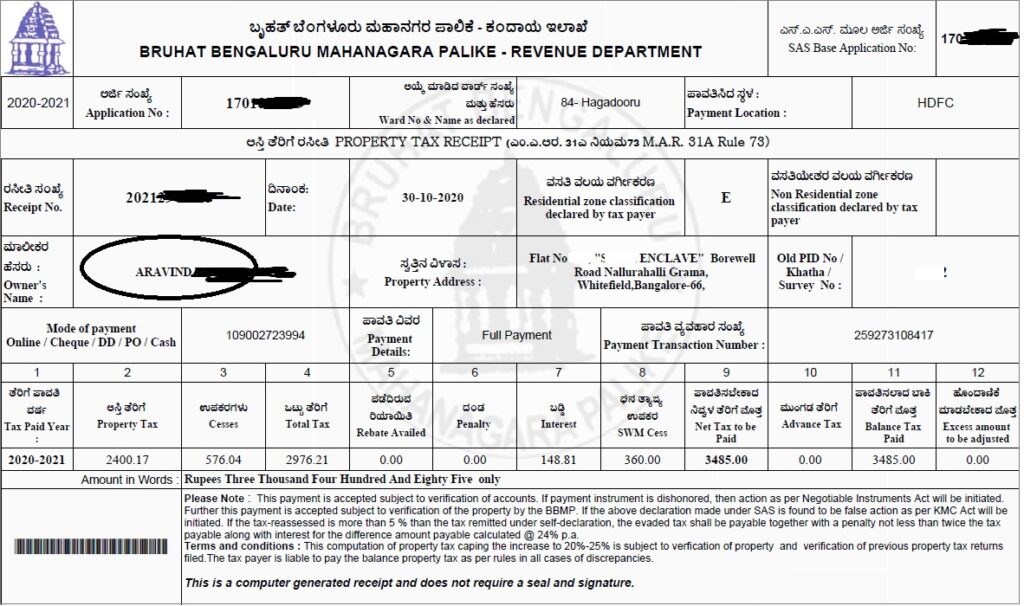

An EC column represents following information

An EC looks like below image

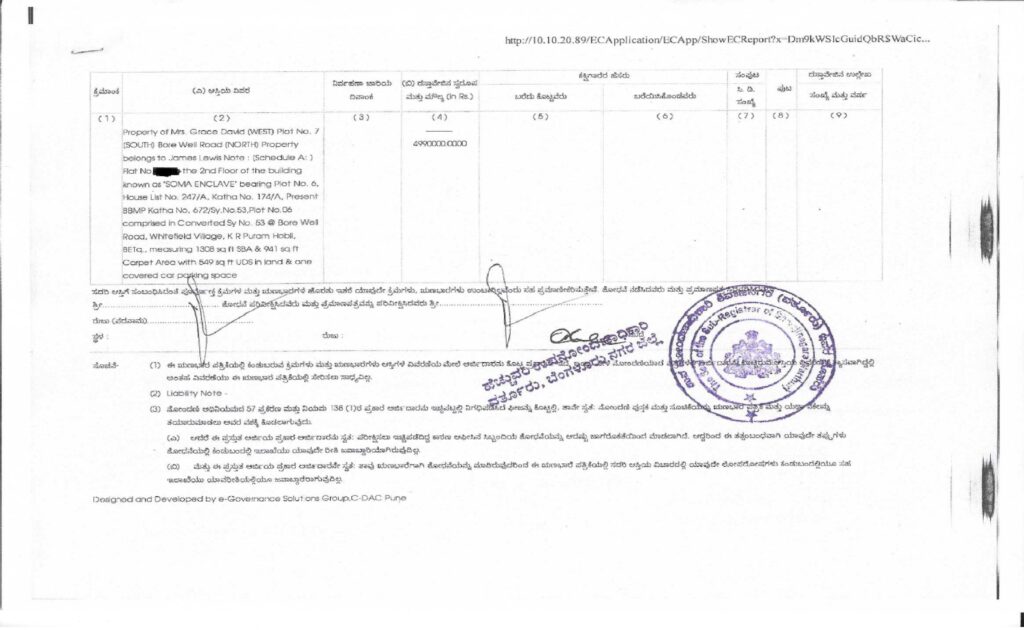

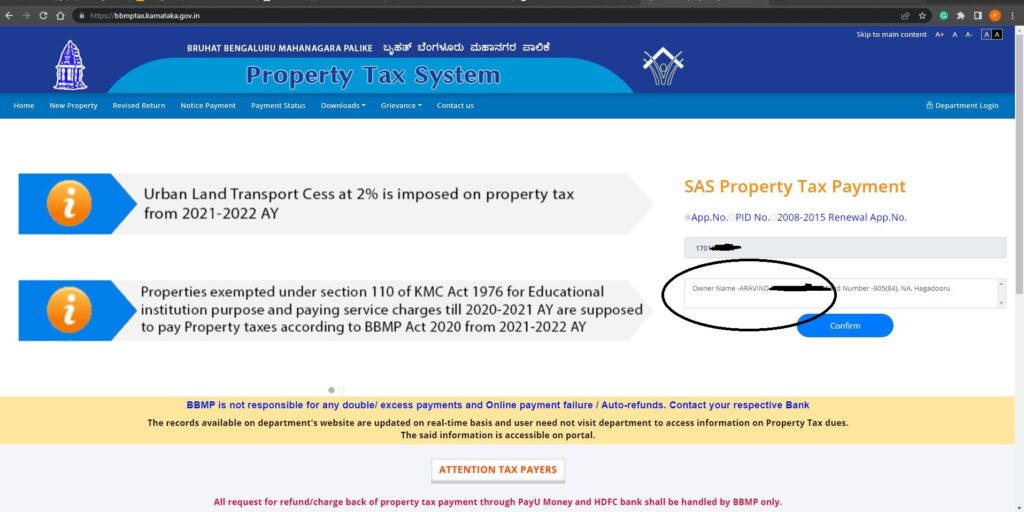

4. Tax paid receipt:

Property owner's name must be on tax paid receipt, we should cross-check the name on tax paid receipt with municipality tax record

For example, The name in below BBMP tax-paid receipt is “ARAVIND”. refer to below image in circle

The same name “ARAVIND” is reflected in BBMP tax record on bbmp website. refer to below image in circle

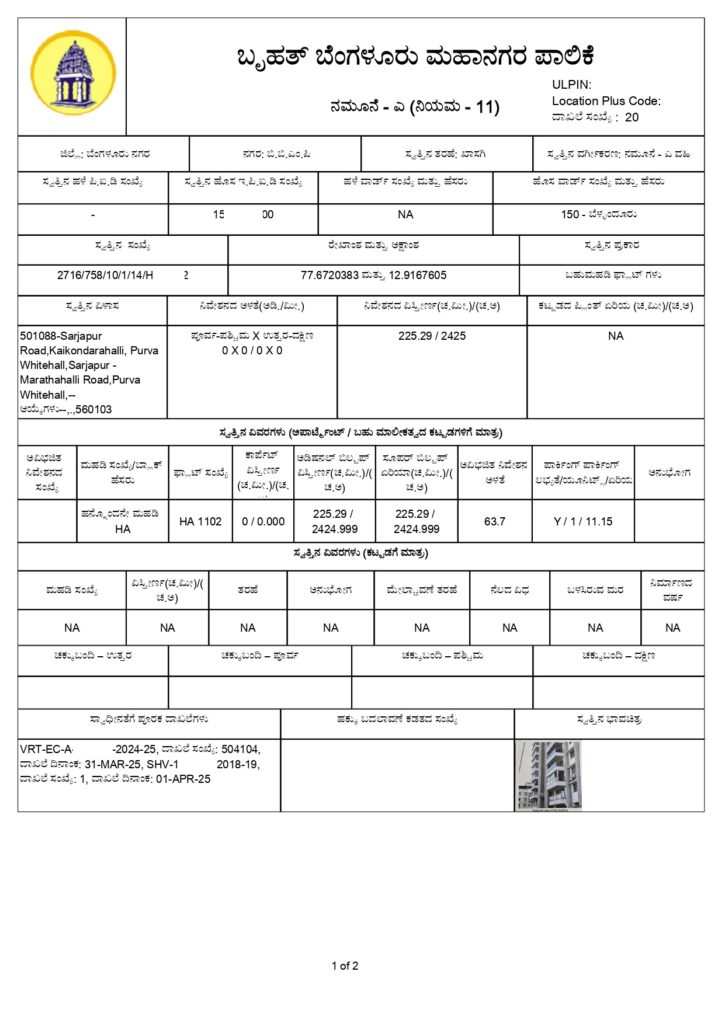

5. eKhata

Property owner's name and property description must be in eKhata. eKhata looks like below image

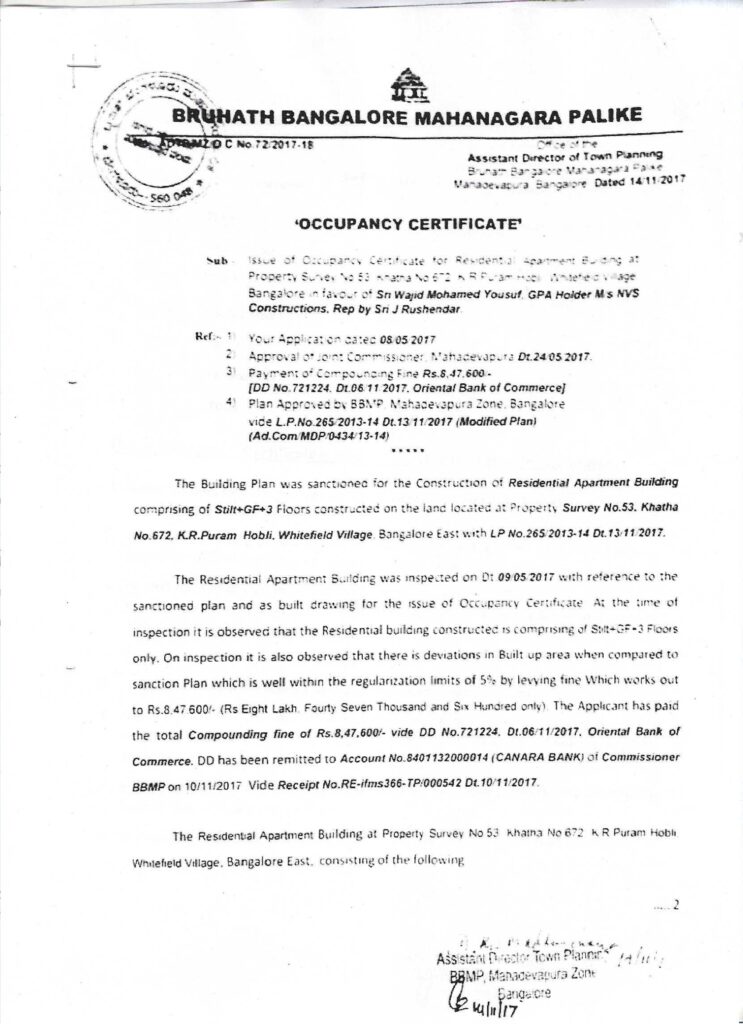

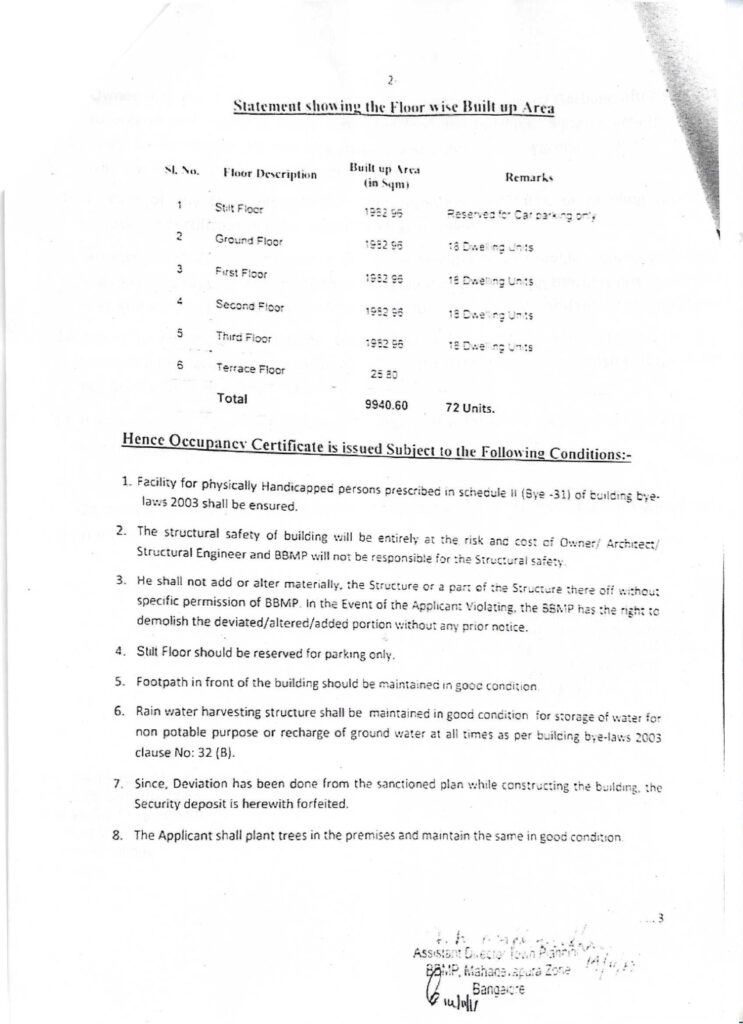

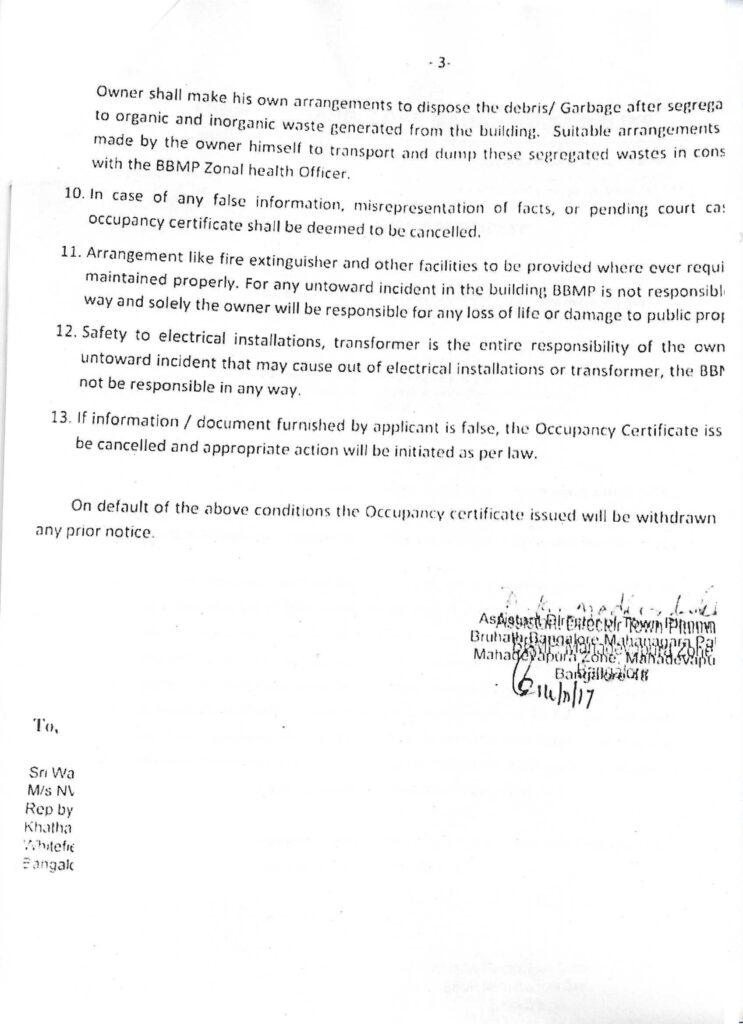

6. Occupancy certificate (OC):

If your seller purchased a property from builder. It's important to verify the occupancy certificate.

If seller has occupancy certificate, the building complies with approved standards. If seller don’t have occupancy certificate, the building is not comply with approved standards.

An occupancy certificate is issued by Town Planning Authority. An occupancy certificate must have details of apartment name, address and measurement.

An occupancy certificate looks like below image

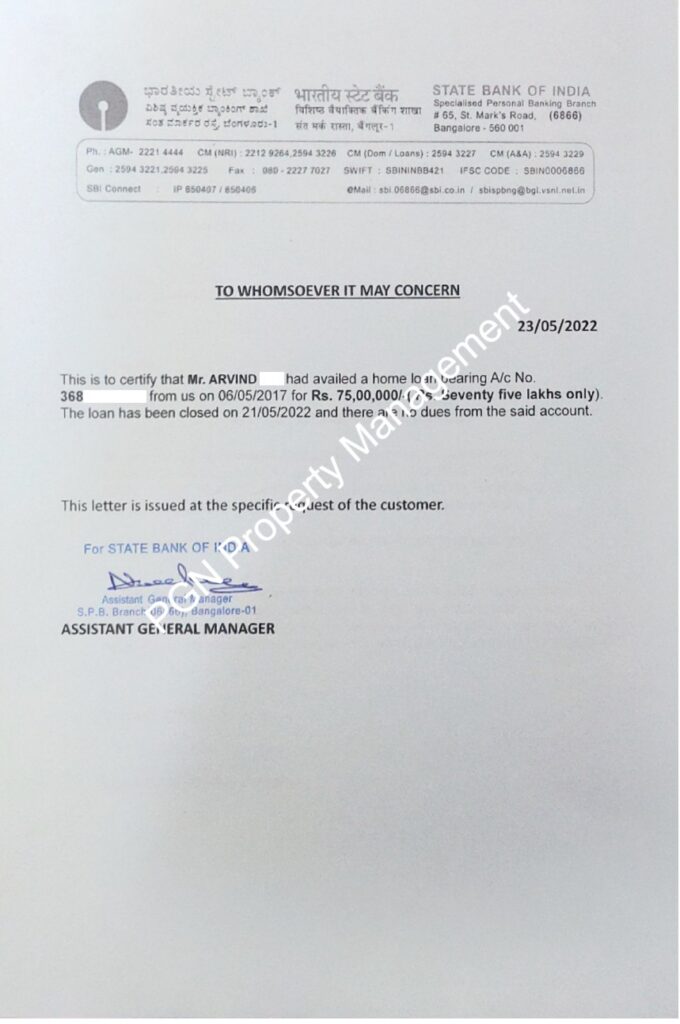

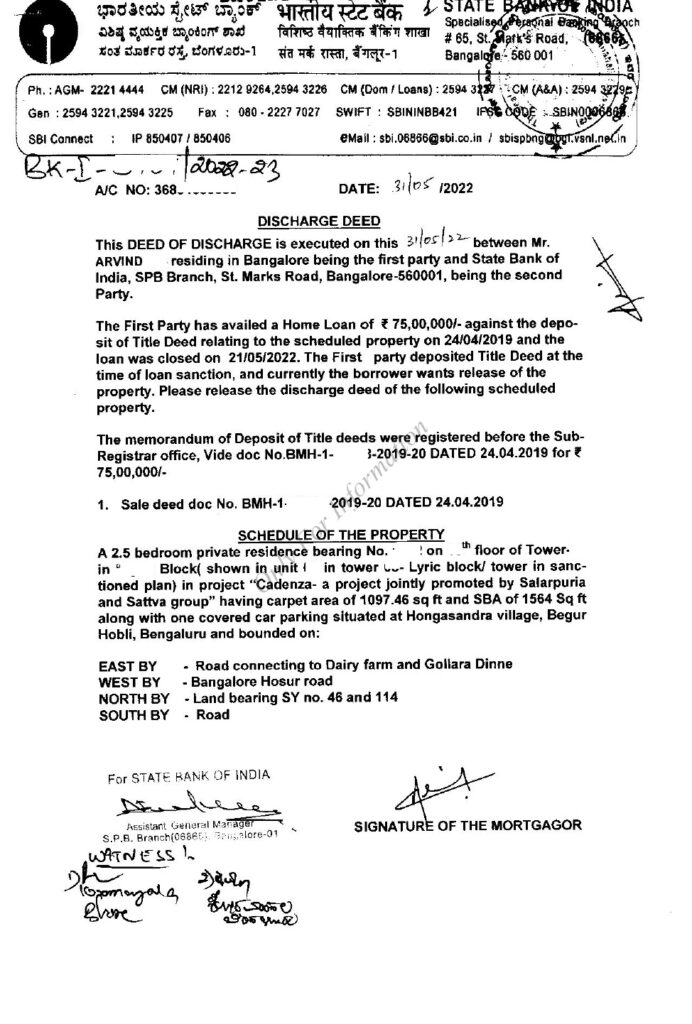

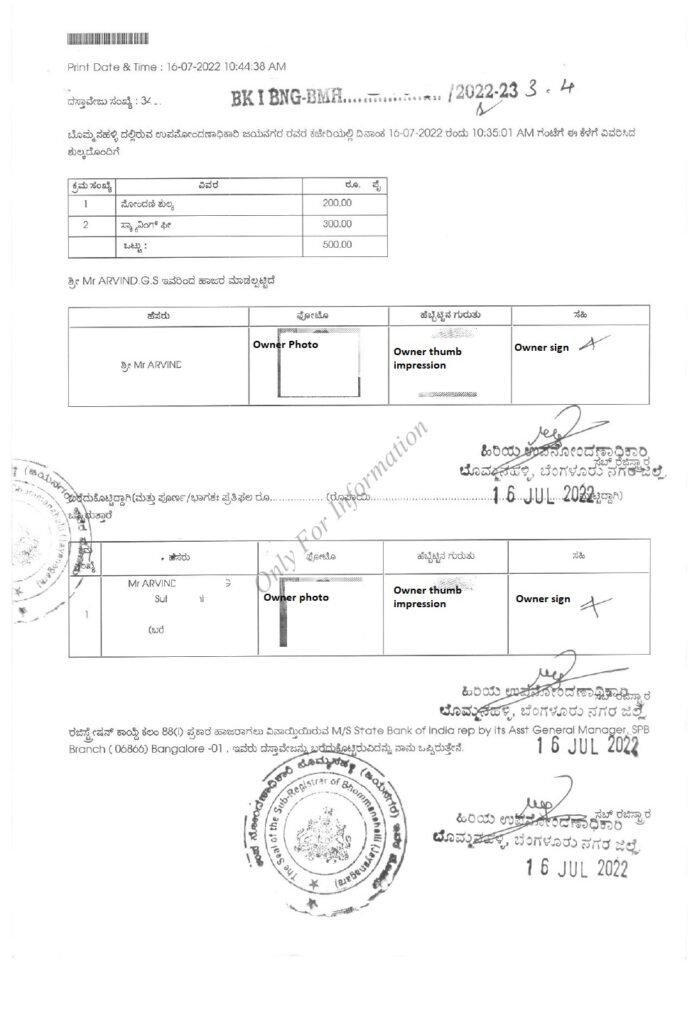

7. No objection certificate from seller’s bank and Registered Discharge Deed:

If seller purchased property on loan, we must make sure that seller cleared the loan. To verify loan clearance by seller

- We need to verify “No Objection Certificate (NOC)” issued by bank. No Objection Certificate should be on bank’s letterhead

- Seller must register the Discharge deed in sub-registrar office

NOC looks like below image:

Registered discharge deed looks like below image:

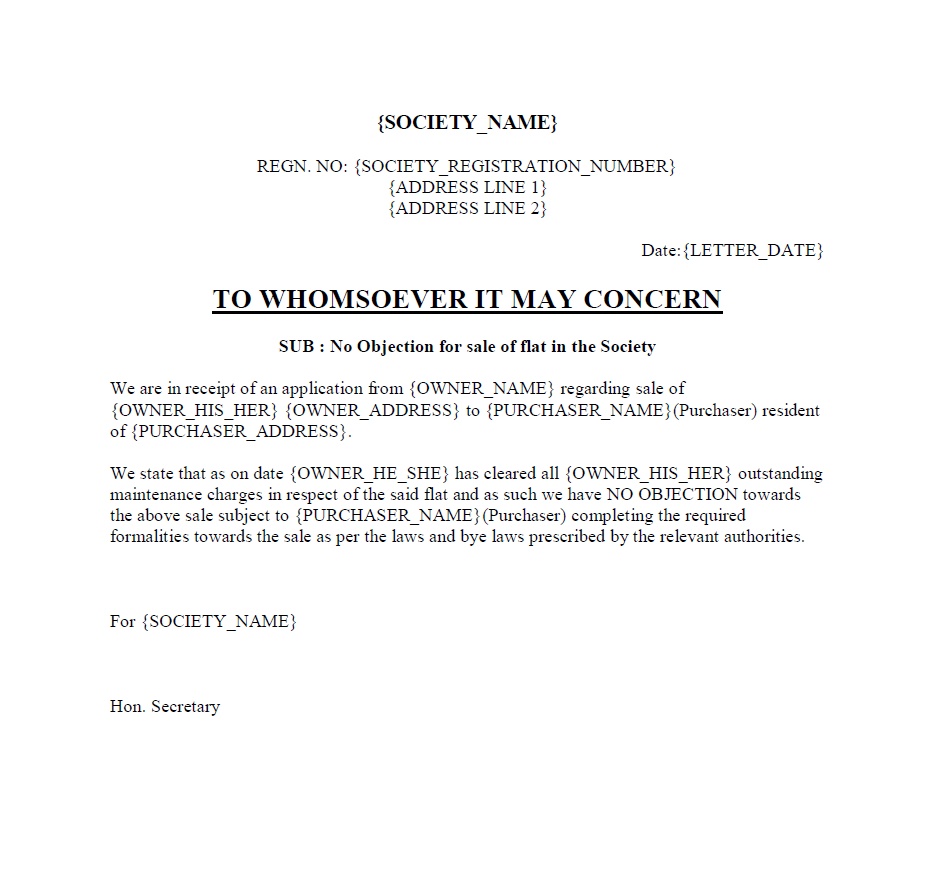

8. No objection certificate from apartment society:

Seller should obtain “No Objection Certificate (NOC)” from builder or apartment association stating that flat has no maintenance or any other due payment. The NOC should be on letterhead.

The NOC contain the details of seller's name, flat number with complete address. Refer to below mock NOC

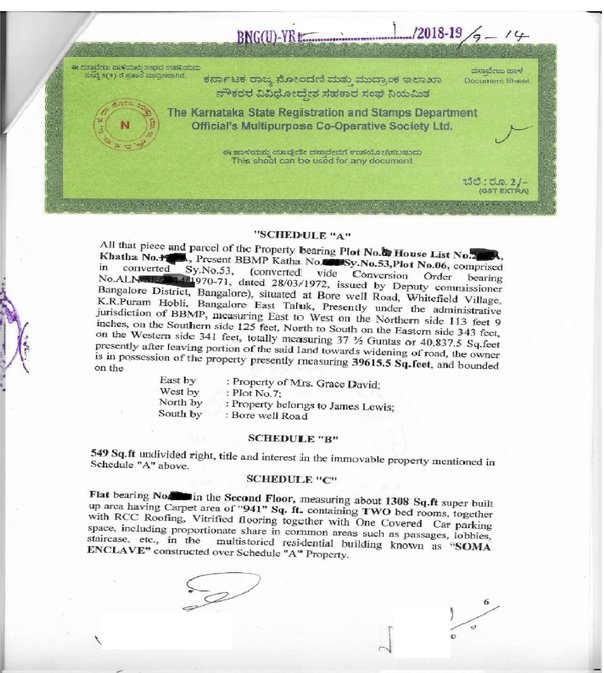

9. Floor plan:

Floor plan check includes carpet area, build-up area, number of balconies and undivided land share.

Such measurements are mentioned in schedule section of sale deed.

10. Seller’s PAN & Aadhaar

Seller’s PAN and aadhaar are mandatory for verification. These ID proofs are required to establish the identity in documents

Make sure that name in ID proof is matching with sale deed, tax-paid receipt, Khata and utility bills of seller's documents.

11. Cancelled cheque from seller

- Cancelled cheque is to establish the seller’s bank details. Going further, you may transact to this account.

- Seller’s cancelled cheque is required for your home loan application,

I hope, we shed some insight on document verification.

We assist in document verification, our verification includes report signed by advocates. To opt for our service, please write to us at pgnproperties@gmail.com or WhatsApp to +91-97424 79020.

Thank you for reading…