Below is the step-by-step procedure to pay Town Municipal Council (TMC) property tax in Bangalore.

Step 1: We should have previous tax-paid receipt; receipt contains the details of owner name, property size and village name of the property location.

Below is the image of previous tax-paid receipt, which we paid in 2020.

Step 2: Visit TMC office (in the jurisdiction where the property is located)

Step 3: Show your previous tax-paid receipt in tax counter, officer provides tax challan.

The tax challan looks like below image. (The challan has three copies, one for bank copy, another for TMC copy and another citizen copy)

Step 4: Visit the nearest Bank of Baroda, show the challan at cash counter and pay the property tax in mode of cash, credit card or debit card.

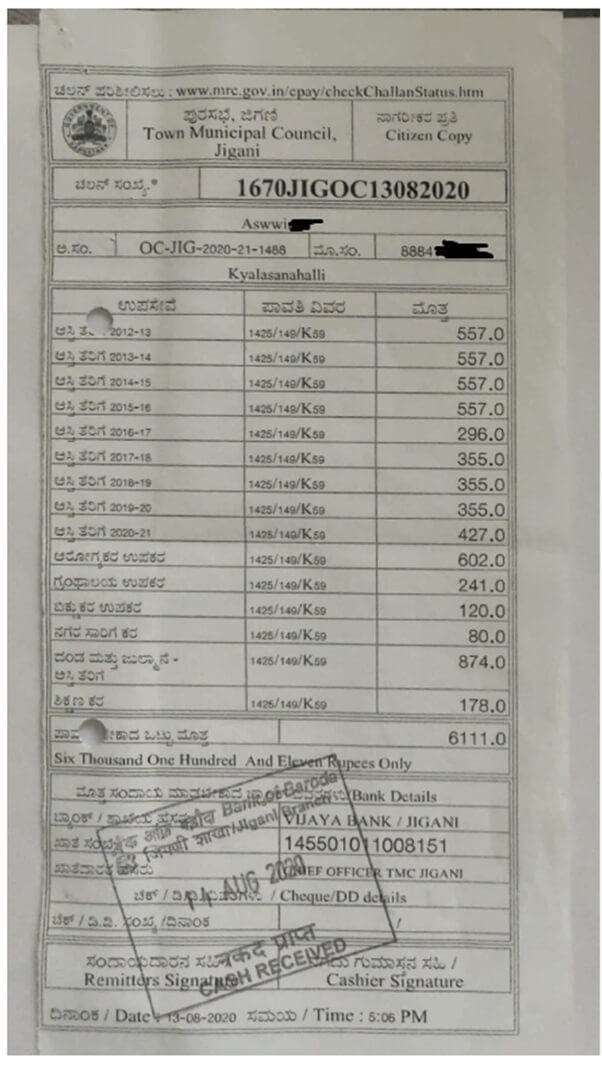

Bank acknowledges the payment with seal & sign on challan. Refer to the below image.

Step 5: Visit back the TMC office with challan acknowledged by bank.

TMC officer acknowledges the receipt of payment and attests the seal on the tax receipt. The receipt looks like below image

This completes the procedure to pay TMC property tax in Bangalore.

Note: No online option to pay TMC property tax. Have to visit TMC office and Bank of Baroda to pay property tax.

We provide end-to-end assistance to pay property tax. To opt for our service, please write to us pgnproperties@gmail.com or whatsApp to + 9 1 – 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…