The gift deed is a registered document through which the property owner transfers property to another person as a gift.

The person gifting property is called the Donor, the person accepting the gift is called Donee

4 Step procedure to Gift a property in Bangalore:

- Documents

- Drafting

- Government fee (Stamp Duty & Registration fee)

- Registration

Below, we explained 4 steps in detail:

- Documents:

To register a gift deed, the donor & donee should have the following documents

- Donor’s registered deed (Sale deed, gift deed, partition deed, Release Deed, WLL Etc..)

- Encumbrance certificate

- Tax paid receipt

- eKhata

- Donor’s Aadhar or Passport

- Donee’s Aadhar or Passport

2. Drafting:

Draft a gift deed in Word format

3. Government fee (Stamp Duty & Registration fee) :

The government fees are different for family members and non-family members. The following people come under family member category

- Father

- Mother

- Brother

- Sister

- Husband

- Wife

- Son/Daughter

Following are the government fee for family members:

- Stamp Duty: Rs. 5000

- Surcharge Rs. 100

- Cess: Rs. 500

- Registration fee: Rs. 1000

- Scanning Rs. 50 per page

Following are the government fee for non-family members: (below % is based on the guidance value or consideration amount, whichever is higher)

- Stamp Duty: 5.1%

- Surcharge 0.1%

- Cess: 0.5%

- Registration fee: 2%

- Scanning Rs. 50 per page

4. Registration:

Below is the step-by-step procedure to register the gift deed in sub-registrar office

Step 1: Submit the applciation on Kaveri Online Services https://kaveri.karnataka.gov.in/landing-page

Must have following documents to submit an application

- Donor’s registered deed (Sale deed, gift deed, partition deed, Release Deed, WLL Etc..)

- Tax paid receipt (of current financial year)

- eKhata

- Donor’s Aadhar or Passport

- Donee’s Aadhar or Passport

- GIFT DEED draft (to be registered)

Step 2: Appliction get approved within 2-3 working days, pay the government fee and book the registration slot

Step 3: Print the Gift Deed draft on document paper. Donor & Donee sign the Gift Deed

Step 4: Take following documents to sub-registrar office for gift deed registration

- Application summary report

- Gift Deed (to be registerd)

- Aadhaar of Donor and Donee

- Govenment fee trsnaction recept

- Two witness and their aadhaar

The donor and donee sit in front of registration counter, officer takes the photo of donor & donee via webcam placed on computer monitor, takes biometric thumb impression and OTP authentication

Step 5: Officer scans the gift deed for government record and handover the hardcopy to presenter (Donor or Donee)

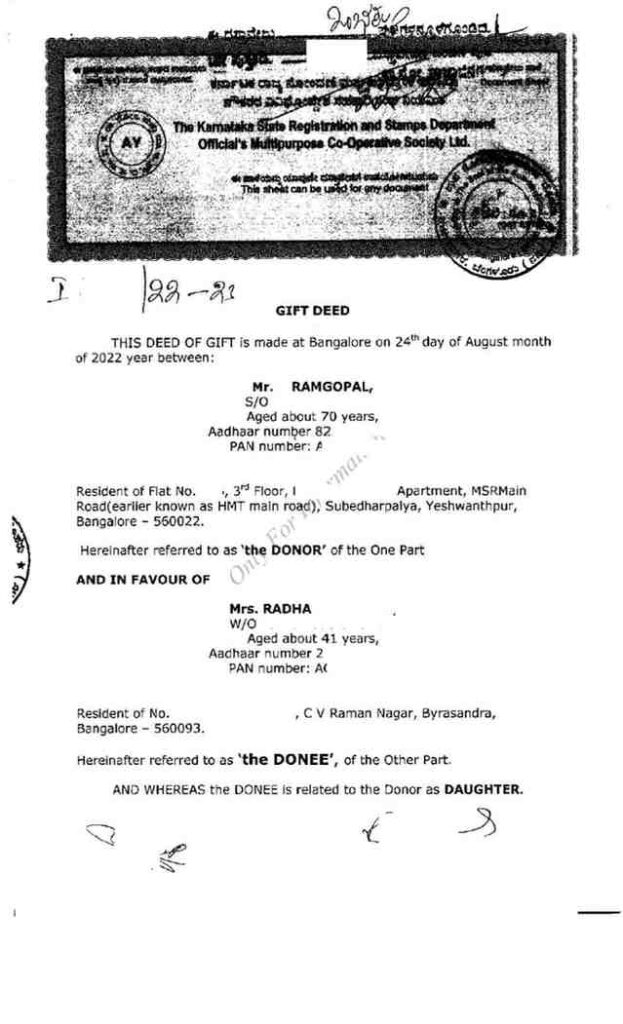

This completes the procedure to register the gift deed. The registered gift deed looks like image below (Father gifted to daughter)

In Bangalore, we provide end-to-end assistance to register gift deed. To opt for our service, please write to us pgnproperties@gmail.com or Whatsapp to + 9 1 - 97424 79020.

Thank you for reading…