Yes, Power of Attorney (POA) holder can do Gift deed to himself

When you draft a POA for gift deed execution, important to mention that POA is application for GIFT DEED execution. To be more specific, mention the donor and donee details in POA.

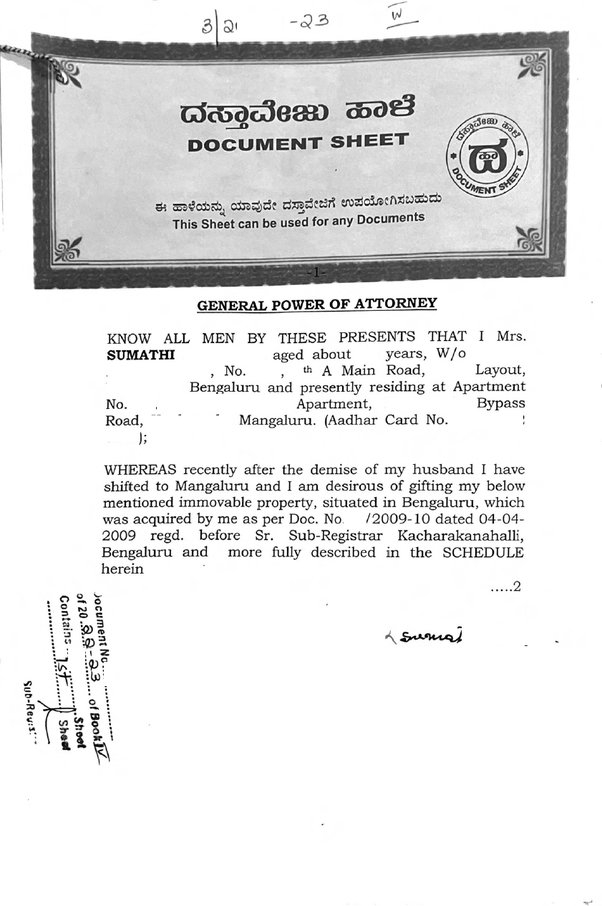

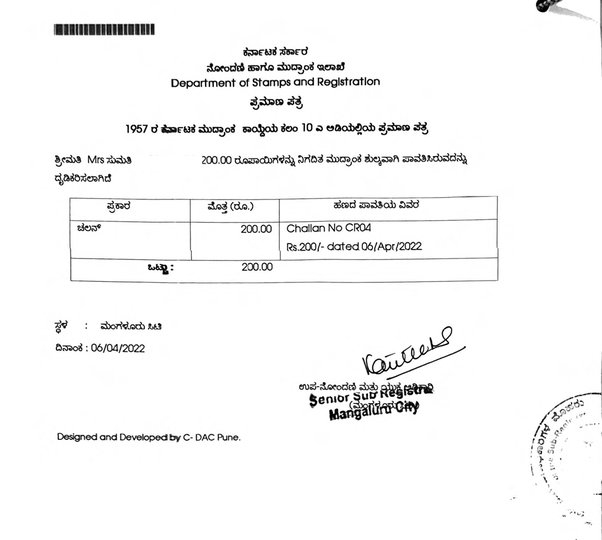

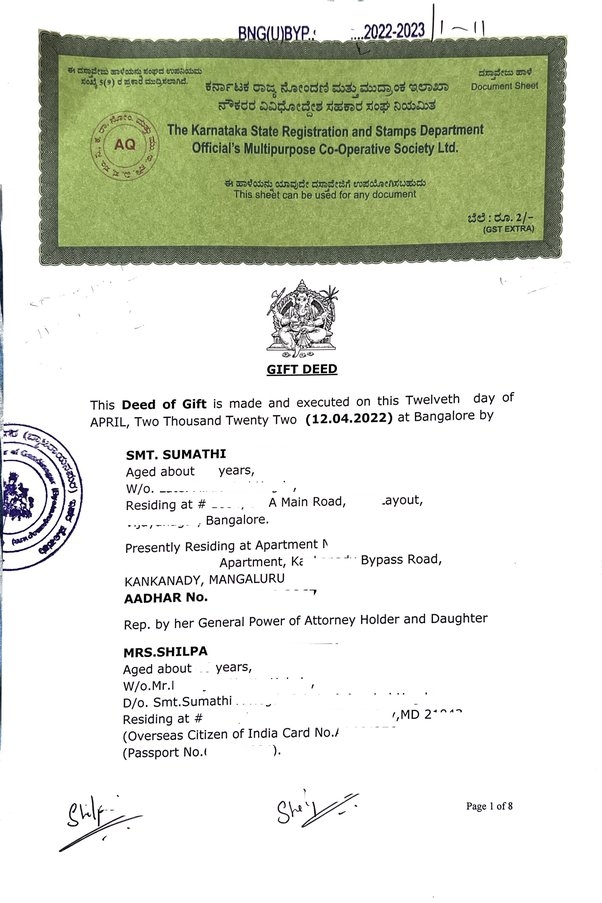

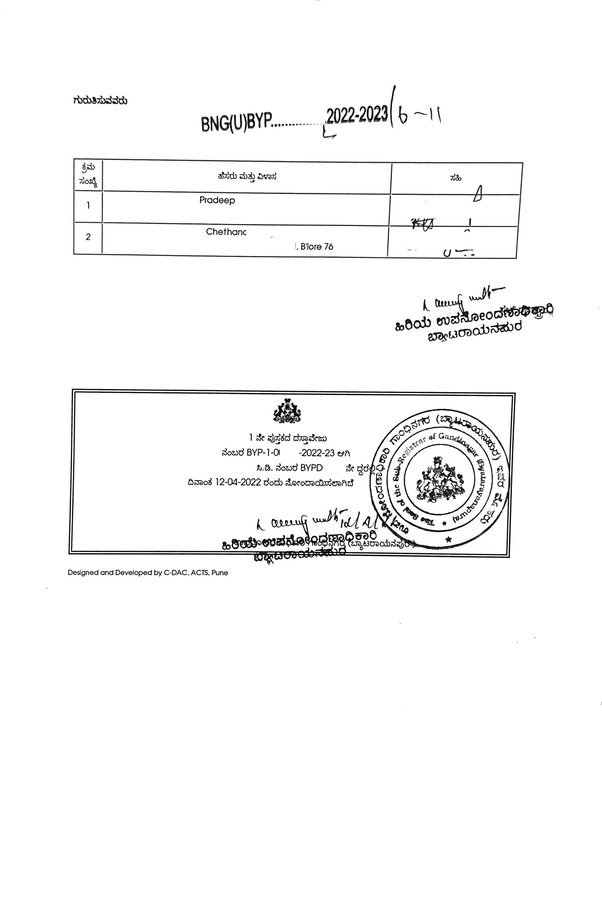

Let me give a real example of executing gift deed through POA, Mother Ms. Sumathi gave GPA to daughter Ms.Shilpa. Below is the image of registered GPA

————-

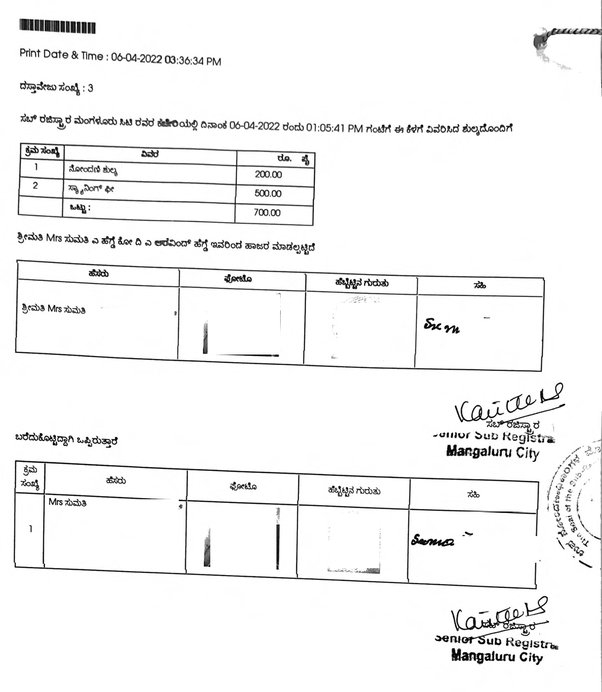

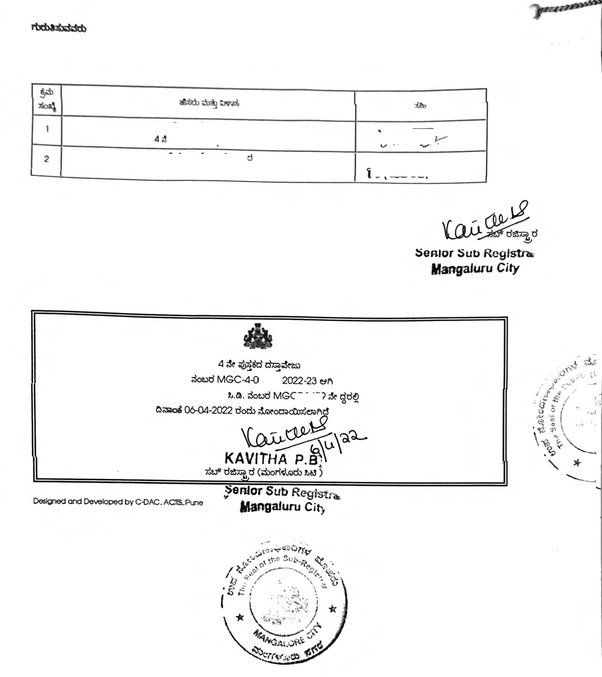

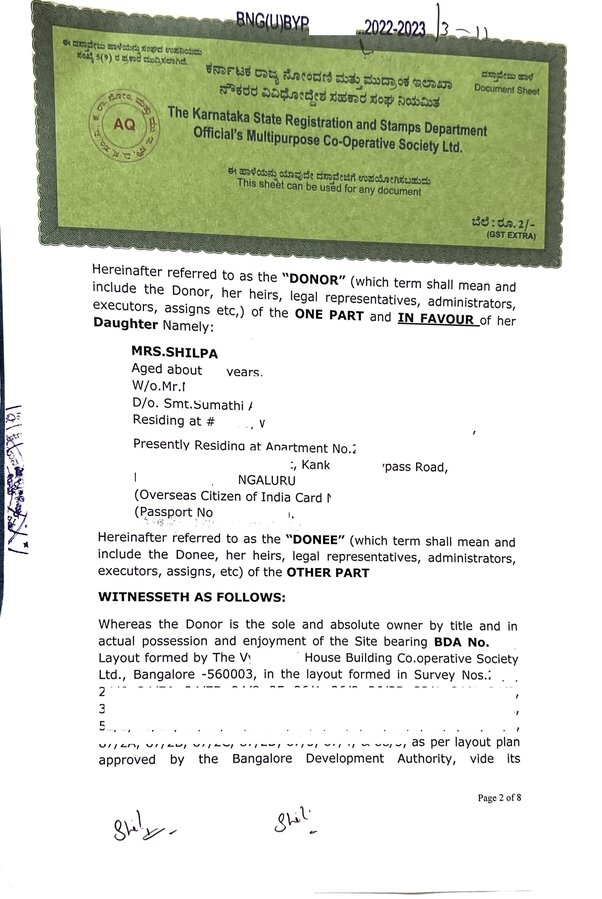

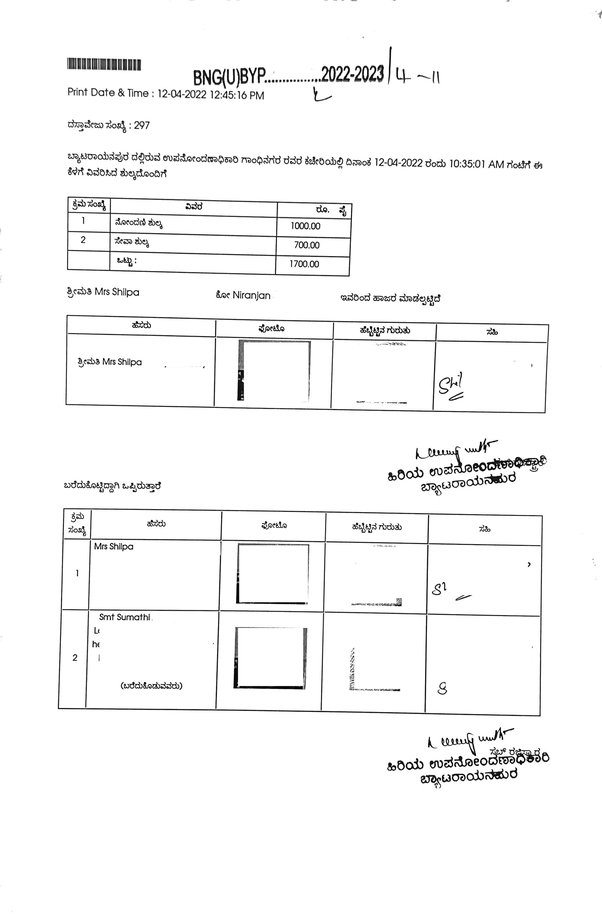

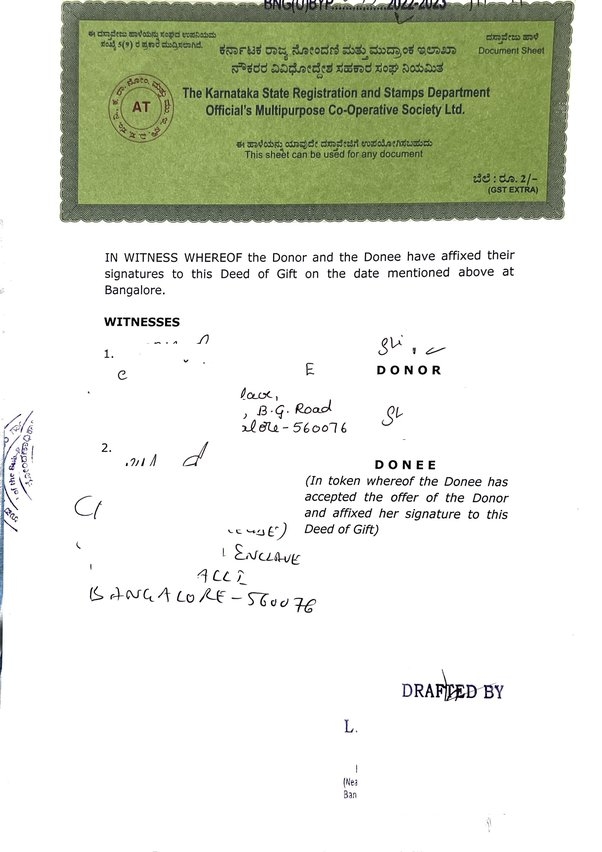

By using the above GPA, daughter Ms Shilpa did Gift deed to herself, Ms.Shilpa represented both donor and donee. Below registered GIFT DEED for your reference.

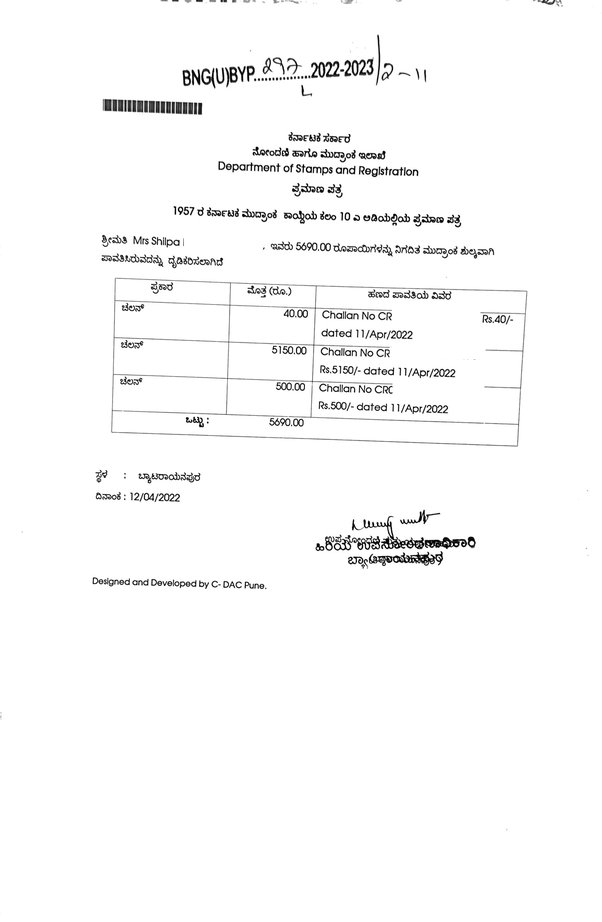

Government charges for GPA holder gifting to blood relative: (in Karnataka)

- Stamp Duty: Rs. 5150

- Registration fee Rs. 1000

- Cess Rs. 500

- Scanning fee Rs. 450 (approx)

Following people come under blood relative category:

- Father

- Mother

- Brother

- Sister

- Wife

- Son/daughter

Note: Uncle, aunt, cousin, in-law, nephew, friends and colleagues come under non-blood relative category.

For non-blood relatives: Government charges are paid based on property guidance value.

Guidance value more than Rs. 35 lakh

- Stamp Duty: 5.1% of property guidance value

- Registration fee: 1% of property guidance value

- Cess: 0.5% of property guidance value

- Scanning fee Rs, 750 (approx)

Guidance value above Rs. 20 lakh and below Rs. 35 Lakh:

- Stamp Duty: 3.06% of property guidance value

- Registration fee: 1% of property guidance value

- Cess: 0.3% of property guidance value

- Scanning fee Rs, 750 (approx)

Guidance value below Rs. 20 Lakh:

- Stamp Duty: 2.04% of property guidance value

- Registration fee: 1% of property guidance value

- Cess: 0.2% of property guidance value

- Scanning fee Rs, 750 (approx)

Note:

Guidance is available online on Kaveri Online service or get at the information counter of sub-registrar office

In Karnataka, government charges are paid on K2 website and generate K2 challan.

——-

In Bangalore, we provide assistance do GPA and gift deed registration. To opt for our service, please write to us pgnproperties@gmail.com or Whatsapp to +91- 97424 79020 .

Thank you for reading…